39 the coupon rate of a bond is equal to

About Corporate Bonds - NSE - National Stock Exchange India Corporate bonds are debt securities issued by private and public corporations. Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business. When one buys a corporate bond, one lends money to the "issuer," the company that issued the bond. S&P/ASX Corporate Bond BBB Rating Band Index The index Launch Date is Dec 12, 2011. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. See More. The S&P/ASX Corporate BBB Index includes all bonds in the S&P/ASX Corporate Bond Index that have the minimum required BBB- rating ...

Purchasing Power Definition - Investopedia Purchasing power loss/gain is an increase or decrease in how much consumers can buy with a given amount of money. Consumers lose purchasing power when prices increase and gain purchasing power when...

The coupon rate of a bond is equal to

Understand Treasuries Contract Specifications - CME Group The minimum price fluctuation, or tick size, is ¼ of a 1/32. Since the face value of the 5-Year Note future is $100,000 a 1/32 is worth $31.25, therefore ¼ of a 1/32 is equal to 0.25 x $31.25 = $7.8125, rounded to the nearest cent per contract. Last trading day and last delivery day are the same as 2-Year Notes. Gold Rate Today: Live Gold Price Per Gram and Ounce The entire precious metals market in general quotes prices in troy ounces. Throughout history, countries have used different systems including the metric system to measure the weight of gold in grams, kilograms, and tonnes, and similar prefixes. 1 gram = 0.032 troy ounces. 1 kilogram = 32.151 troy ounces. 1 tonne = 32,151.7 troy ounces. Are Premium Bonds a good investment? - Times Money Mentor And if you have the maximum £50,000 in bonds, your chances increase to one in 81,458. Each £1 bond has an equal chance of winning. So to boost your chances, the more you buy, the more your ...

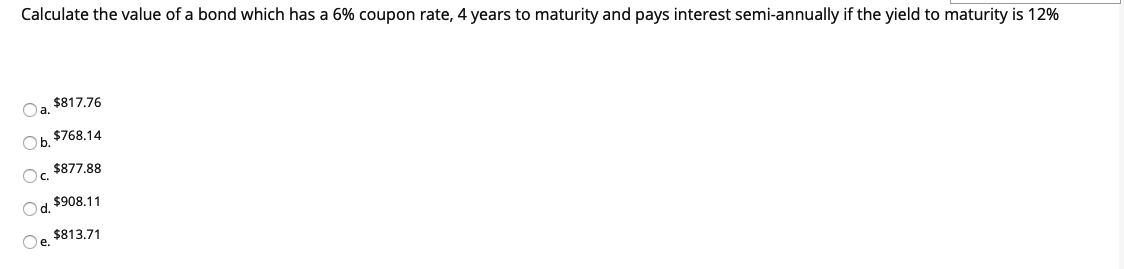

The coupon rate of a bond is equal to. Dividend Yield - BrainMass The bond, which has a $1,000 face value and coupon rate equal to 10 percent, matures in six years. Interest is paid every six months; the next interest payment is scheduled for six months from today. If the yield on similar-risk investments is 14 pe Eurodollar Futures Pricing and the Forward Rate Market - CME Group This implies a return of 0.800% over the entire six-month period. The third alternative means that you invest for the next 270 days at 0.90% and sell June Eurodollar futures at 1.04%, effectively committing to sell the spot investment 180 days hence when it has 90 days until maturity. This implies a return of 0.83% over the next six-months. 3 Copper ETFs to Consider in 2022 | The Motley Fool The ETF's holdings include copper futures contracts and an equal amount of cash and equivalents serving as collateral. The ETF has a rather high expense ratio of 1.08%. Guggenheim Strategic Opportunities Fund Furthermore, interest rates and bond yields may fall as a result of types of events, including responses by governmental entities to such events, which would magnify the Fund's fixed-income instruments' susceptibility to interest rate risk and diminish their yield and performance. ... the Fund risks a loss equal to the entire value of the ...

Market Yield on U.S. Treasury Securities at 1-Year Constant Maturity ... View a 1-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Germany 10 Years Bond - Historical Data - World Government Bonds Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield. Other columns refers to hypothetical yields variations (100 bp = 1%). Germany Government Bonds Back to Germany Government Bonds - Yields Curve Related Topics Sovereign CDS World Credit Ratings The Fed - H.15 - Selected Interest Rates (Daily) - May 27, 2022 The 1-, 2-, and 3-month rates are equivalent to the 30-, 60-, and 90-day dates reported on the Board's Commercial Paper Web page ( ). 6. Book III - Conditions of Employment | Bureau of Labor Relations Art. 108. Posting of bond. An employer or indirect employer may require the contractor or subcontractor to furnish a bond equal to the cost of labor under contract, on condition that the bond will answer for the wages due the employees should the contractor or subcontractor, as the case may be, fail to pay the same. Art. 109. Solidary liability.

FBND | ETF Snapshot - Fidelity Snapshot for the FIDELITY TOTAL BOND ETF ETF (FBND), including recent quote, performance, objective, analyst opinions, and commentary. ... Weighted Average Coupon AS OF 04/30/2022: 2.96%: 30-day SEC Yield AS OF 04/29/2022: 3.46%: Distribution Yield (TTM) ... If only one NRSRO rates the security, that rating is assigned to the holding. If a ... Best CD Rates Of May 2022 - Forbes Advisor 1.25% to 2.60% Minimum Deposit Requirement $5,000 Terms 12 Months to 5 Years Why We Picked It Pros & Cons Details First National Bank of America Certificate of Deposit 4.7 Learn More Read Our Full... Convert GBP to USD How to Convert GBP to USD. 1 British Pound Sterling = 1.2612726241 United States Dollar. 1 United States Dollar = 0.79285 British Pound Sterling. Example: convert 15 British Pound Sterling to United States Dollar: 15 British Pound Sterling = 15 × 1.2612726241 United States Dollar = 18.9190893612 United States Dollar. In the Money (ITM) Definition - Investopedia In the money means that a call option's strike price is below the market price of the underlying asset or that the strike price of a put option is above the market price of the underlying asset ...

How to Calculate Holding Period Return | The Motley Fool In order to convert holding period return to an annualized number, you'd follow the formula below: Source: The Motley Fool. Note that "t" represents the time in years expressed in your holding ...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 1.924% yield. 10 Years vs 2 Years bond spread is 49 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Best Equal-Weight ETFs for 2022 - The Balance The expense ratio of 0.57%, equal to $5.70 for every $1,000 invested in the fund, is on the high end for the funds on our list, but the fund also has more than $1 billion in assets. While it's less than a few other funds on our list, you should still be able to easily buy and sell shares with this level of liquidity. 4

Current Rates | Edward Jones 3.25%. $5,000,000 to $9,999,999. 3.00%. $10,000,000 and over. 2.75%. Rates effective as of March 16, 2020 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate.

The Fed - Commercial Paper Rates and Outstanding Summary Data as of May 26, 2022 Posted May 27, 2022. The commercial paper release will usually be posted daily at 1:00 p.m. However, the Federal Reserve Board makes no guarantee regarding the timing of the daily posting. This policy is subject to change at any time without notice.

Debentures in Accounting - eFinanceManagement A debenture is a document that acknowledges the debt. Debentures in accounting represent the medium to long term instrument of debt that the large companies use to borrow money. The term debenture is used interchangeably with terms bond, note, or loan stock. The company issues the debentures under the seal of the company.

How to Calculate APR | Indeed.com Interest accrued = A - P = $2200 - $2000 and interest = $200. Next, add the interest to the closing cost. Using the APR formula, fees + interest = $200 + $200 = $400. Finally, divide the loan amount and the number of periods, then multiply by 100 to get a percentage. APR = (400/2000) / 2 x 1 x 100 = 10%.

30% Off - Chegg Coupons - May 2022 All Valid Chegg Discount Codes & Offers in May 2022. DISCOUNT. Chegg COUPON INFORMATION. Expiration Date. 30%. Save Big: 30% off. Currently, there is no expiration date. 30%. Save Big: 30% off.

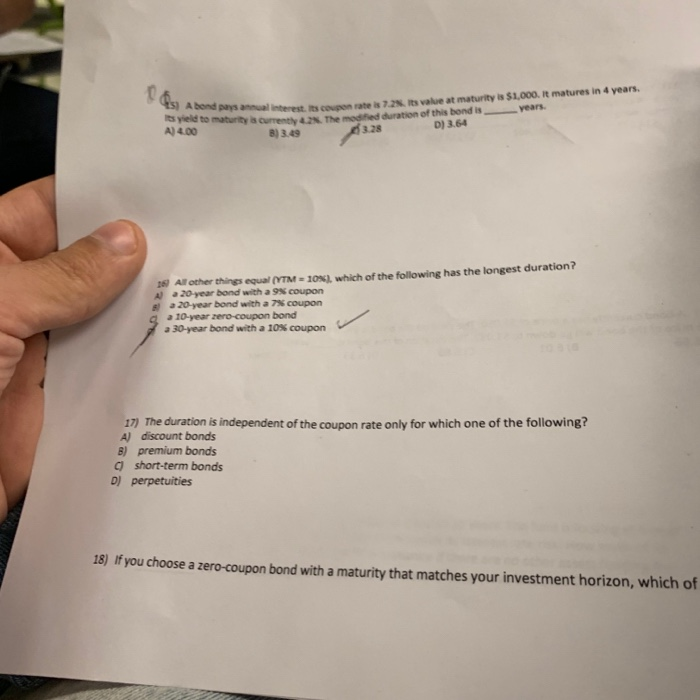

Modified Duration | Brilliant Math & Science Wiki By substituting in the formula for Modified Duration, we get that 4.445 = - \frac {1} {1100} \times \frac { \Delta P } { 1 \% }. 4.445 = −11001 × 1%ΔP . This gives us \Delta P = - 4.445 \times 1100 \times 1 \% = - \$48.895 ΔP = −4.445×1100×1% = −$48.895. Thus, the new price would be P + \Delta P = \$1100 - \$48.895 = \$1051.105.

TLT iShares 20+ Year Treasury Bond ETF - SeekingAlpha A high-level overview of iShares 20+ Year Treasury Bond ETF (TLT) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

Treasury Rates, Interest Rates, Yields - Barchart.com Interest rate trends and historical interest rates for Treasuries, bank mortgage rates, Dollar libor, swaps, yield curves. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky investment ...

Are Premium Bonds a good investment? - Times Money Mentor And if you have the maximum £50,000 in bonds, your chances increase to one in 81,458. Each £1 bond has an equal chance of winning. So to boost your chances, the more you buy, the more your ...

Gold Rate Today: Live Gold Price Per Gram and Ounce The entire precious metals market in general quotes prices in troy ounces. Throughout history, countries have used different systems including the metric system to measure the weight of gold in grams, kilograms, and tonnes, and similar prefixes. 1 gram = 0.032 troy ounces. 1 kilogram = 32.151 troy ounces. 1 tonne = 32,151.7 troy ounces.

Understand Treasuries Contract Specifications - CME Group The minimum price fluctuation, or tick size, is ¼ of a 1/32. Since the face value of the 5-Year Note future is $100,000 a 1/32 is worth $31.25, therefore ¼ of a 1/32 is equal to 0.25 x $31.25 = $7.8125, rounded to the nearest cent per contract. Last trading day and last delivery day are the same as 2-Year Notes.

![[Answer] All else constant, a bond will sell at when the coupon rate is ...](https://inkz.net/wp-content/uploads/2019/04/all-else-constant-a-bond-will-sell-at-when-the-coupon-rate-is-the-yield-to-maturity-768x299.jpg)

Post a Comment for "39 the coupon rate of a bond is equal to"