45 coupon rate of bond

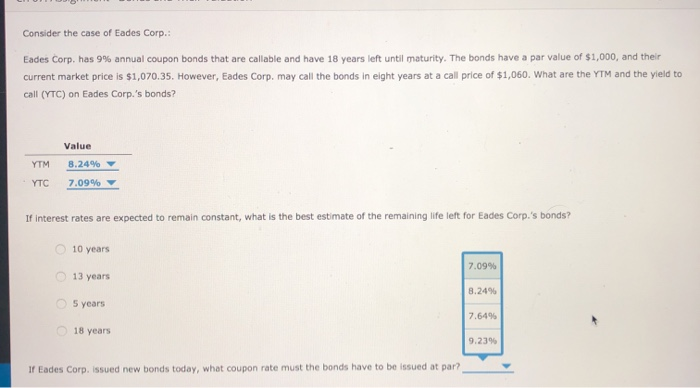

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued.. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Hence, a higher coupon rate bond, …

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon rate of bond

Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in bond price. When coupon rate remains high, bond price falls. Share LINE. Latest Stats. US 10-year T-Note Futures Price (R) 2022-05-30. 120.55. US 10-year Note Auction Coupon Rate (L) Coupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Bonds Coupon Rate : Latest News, Bonds Coupon Rate Videos and Photos ... News. Videos. Indian bonds supply glut to driver yields to 8%: Report. home. bonds coupon rate.

Coupon rate of bond. Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 › terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Fixing of coupon rates - Nykredit Realkredit A/S Bonds with semi-annual interest rate fixingThe new coupon rates will apply from 1 July 2022 to 31 December 2022: Uncapped bondsDK0009520017, (32H), maturity in 2023, new rate as at 1 July 2022: 0 ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves combined. Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

How is the coupon rate of a bond calculated? - Quora Answer (1 of 3): The coupon rate is fixed when the bond is issued. It never changes. The term "coupon" is an old-fashioned term dating back to when borrowers —- Governments or Companies—- actually issued paper, bearer bonds. You'd lend the US Treasury $1000, and they would hand you an IOU with c...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 98.17: 0 ...

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

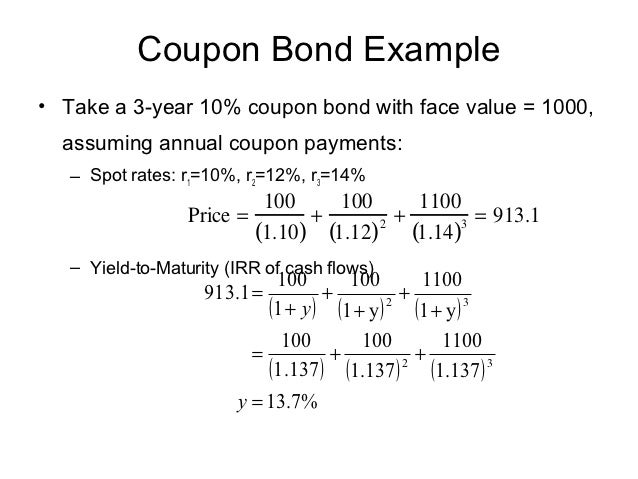

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at …

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond.

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In this article, we will learn to calculate the coupon rate in Excel.In Microsoft Excel, we can use a basic formula to determine the coupon rate easily.Today, we will discuss 3 ideal examples to explain the coupon rate.Also, we will demonstrate the process to find the coupon bond price in Excel. So, without further delay, let's start the discussion.

› terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What is a Coupon Rate? - Definition | Meaning | Example Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

T-bonds coupon rate 30.6bps higher than benchmark The security fetched a coupon rate of 7.25 percent, which was 30.6 basis points (bps) higher than the comparable secondary market benchmark rate of 6.944 percent.

Post a Comment for "45 coupon rate of bond"