39 yield to maturity of a zero coupon bond

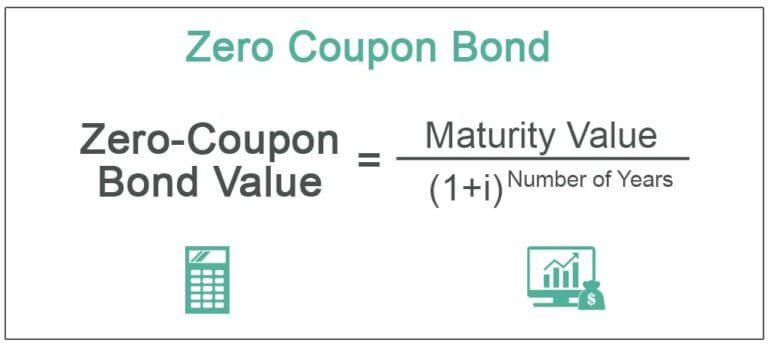

What is the yield to maturity (YTM) of a zero coupon bond with a face ... A bond mature in 7 years. The bonds face value is Php50.000 and pays a 6% annual coupon interest rate. The yield to maturity on this bond is 8.5%. a) What Annual interest payment? If the bond has a 6% coupon rate, but an 8.5% yield to maturity, it means the bond currently have a "market value" less than 50,000. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Yield to maturity of a zero coupon bond

Yield Bond Python Curve 10-year yield at 1 In the USA-centric news sources and others, that's Treasuries We have a 0 Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0 Bond valuation can be done using an yield to maturity or using a zero yield curve Bond valuation can be done using an yield to maturity or using a zero yield curve. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... What would the yield to maturity be on a four year zero coupon bond ... An inverted yield curve is one A) with a hump in the middle. B) constructed by using convertible bonds. C) that is relatively flat. D) that plots the inverse relationship between bond prices and bond yields. E) that slopes downward. Answer: E Difficulty: Easy Rationale: An inverted yield curve occurs when short-term rates are higher than long-

Yield to maturity of a zero coupon bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Yield to maturity - Wikipedia For the $99.44 investment, the bond investor will receive $105 and therefore the yield to maturity is 5.56 / 99.44 for 5.59% in the one year time period. Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Solved "A zero-coupon bond has a yield to maturity of 5% and - Chegg See the answer "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. " Expert Answer 100% (1 rating) Bond price of zero coupon bond today = Matu … View the full answer Previous question Next question Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Solved 15, A zero-coupon bond has a yield to maturity of 9% - Chegg 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Answered: What is the current yield on a zero… | bartleby What is the current yield on a zero coupon bond with a remaining life of 11 years, a yield to maturity of 5.1%, and a par value of $1000? (Round to 100th of a percent and enter as a percentage, e.g. 12.34% as 12.34 and state as an annual rate. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios.

What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ...

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math However, there is no inherent reason why the annual yield on a zero-coupon bond cannot be calculated for quarterly, monthly, daily, or even hourly compounding. Those yields turn out to be 5.141%, 5.119%, 5.109%, and 5.108% using PER = 4,12, 365, and 365 * 24, respectively.

Zero Coupon Yield Curves Technical Documentation Bis Bond Yields: Nominal and Current Yield, Yield to Maturity Nominal yield, or the coupon rate, is the stated interest rate of the bond. This yield percentage is the percentage of par value —$5,000 for municipal bonds, and $1,000 for most other bonds — that is usually paid semiannually.

Zero Coupon Bond Ytm - bizimkonak.com How to Calculate Yield to Maturity of a Zero-Coupon Bond. CODES (2 days ago) Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows . Visit URL

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Post a Comment for "39 yield to maturity of a zero coupon bond"