43 bond yield vs coupon rate

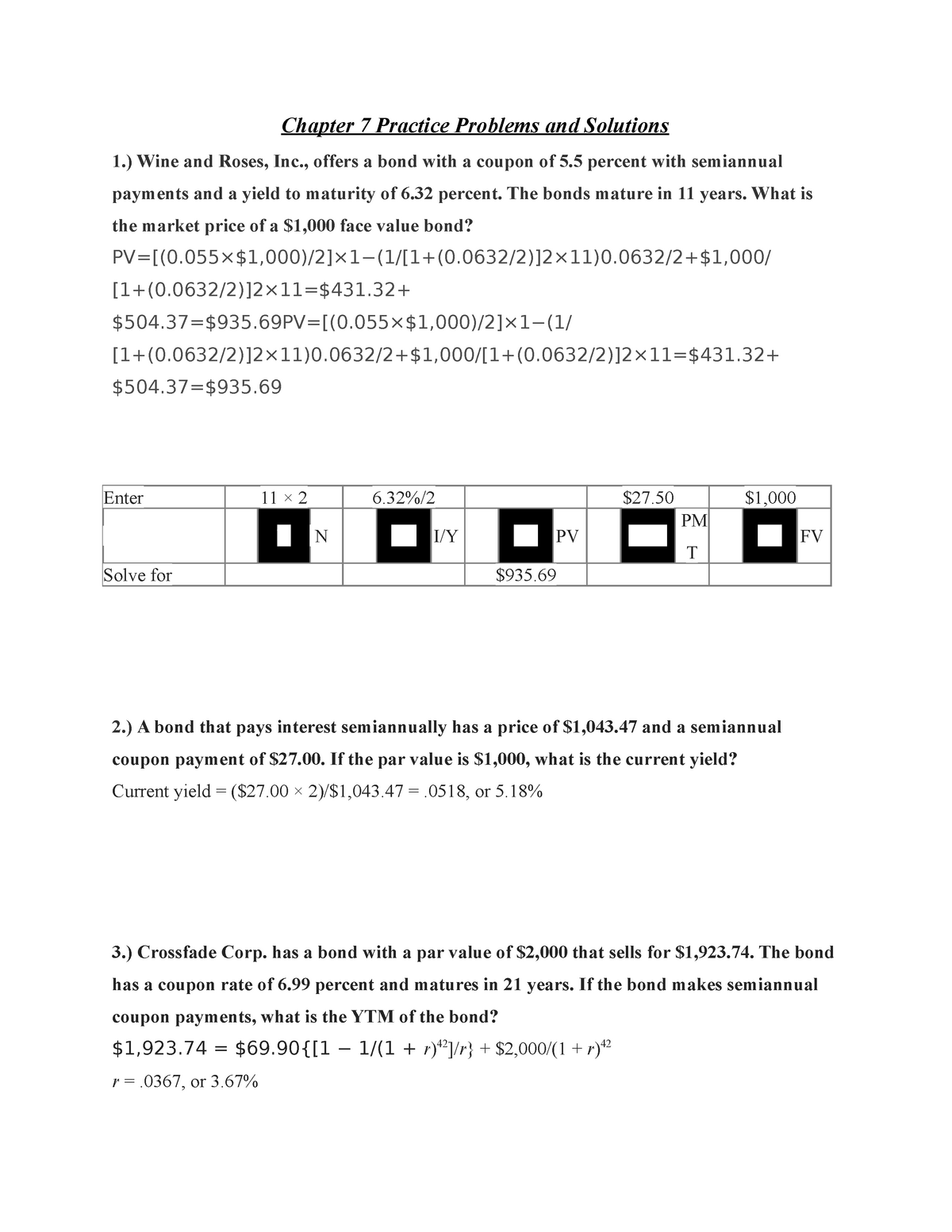

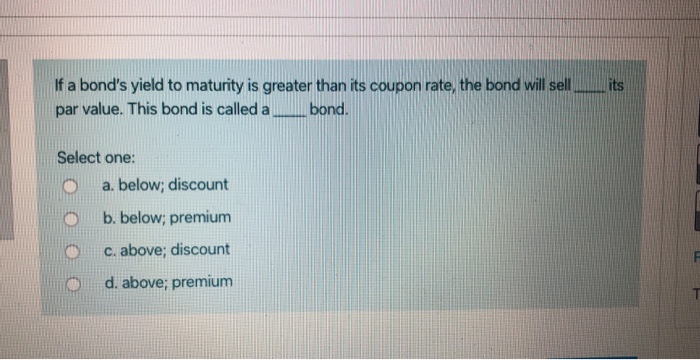

Key Differences: Bond Price vs. Yield - SmartAsset To compensate for that, corporations issuing bonds at a lower rate must offer buyers a discount. Bond Price and Interest Rate Example. Let's say you purchase a bond from ABC Corp. that comes with a coupon rate of 5%. Three possibilities follow: The prevailing interest rate stays the same as the bond's coupon rate. Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

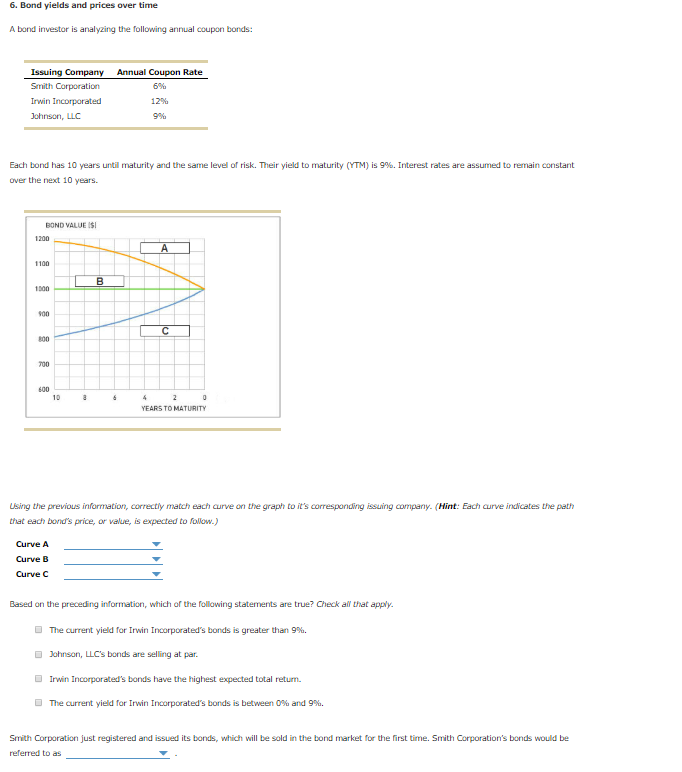

Coupon rate definition — AccountingTools The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield is higher than the coupon rate. Conversely, if the investor pays more than the face amount, the current yield is lower than the coupon rate.

Bond yield vs coupon rate

China Government Bonds - Yields Curve 27.09.2022 · The China 10Y Government Bond has a 2.767% yield.. 10 Years vs 2 Years bond spread is 63 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.65% (last modification in August 2022).. The China credit rating is A+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 110.98 and implied probability … Relationship Between Price, Yield and Duration | Bonds - PFhub Bonds with higher coupon rates have lower convexity, while zero coupon bonds have the highest convexity. The price yield graph of a straight bond always have a positive convexity. The slope of the tangent to the graph will increase when yield decreases. This means that the duration of such a bond will increase as yield decreases. On the other ... Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

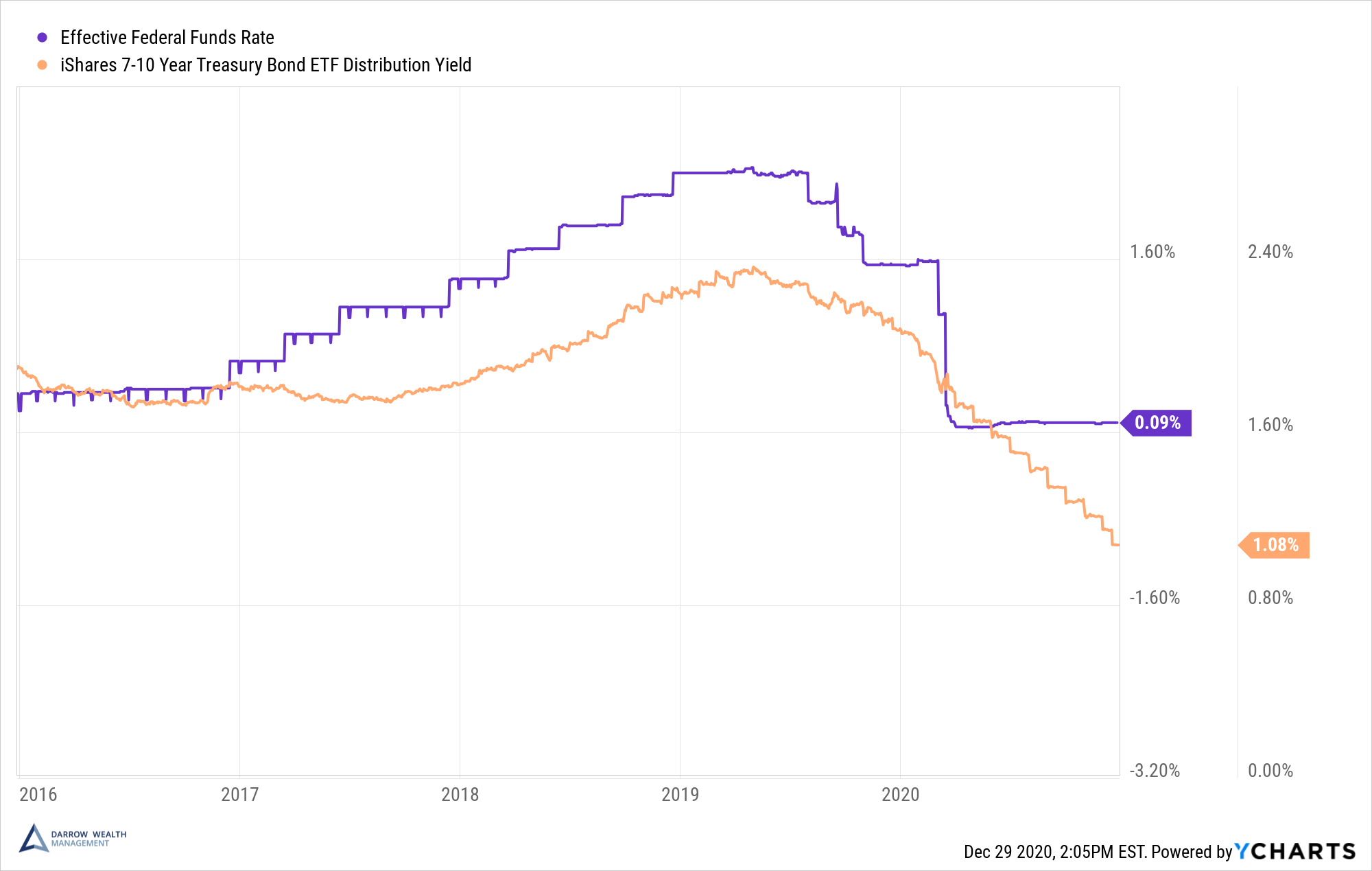

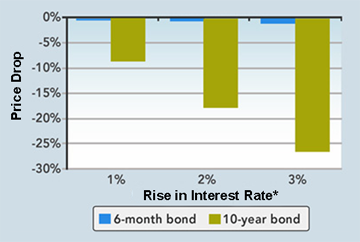

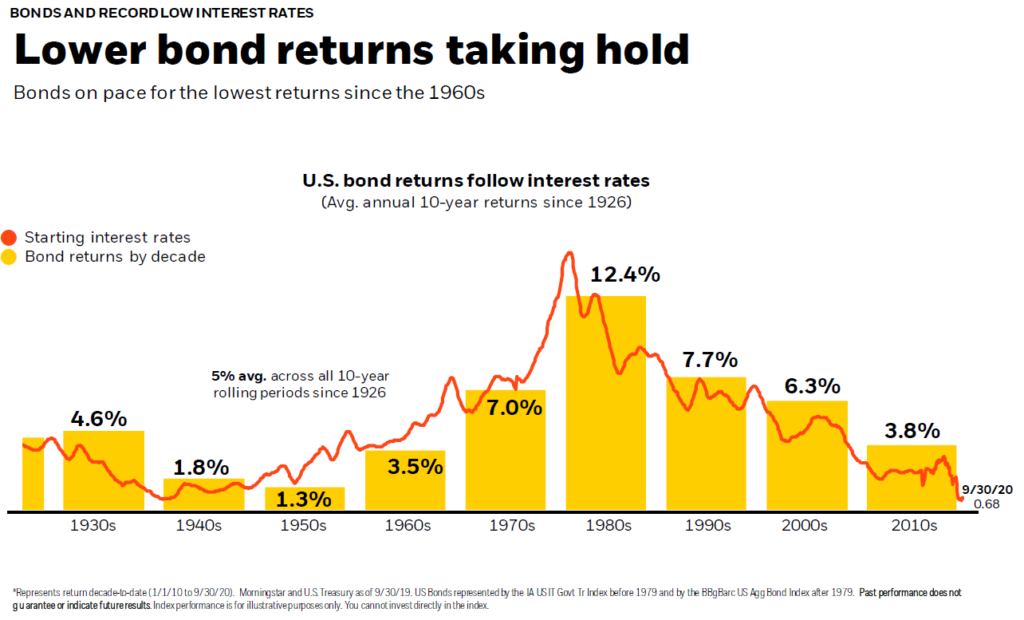

Bond yield vs coupon rate. Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. Explaining Yields vs Coupon rate of Bonds - Orb52 For example when issuing the bonds, if they are issued at a face value of ₹10,000 and the coupon rate on the bond is 10% then the interest rate that will be paid is ₹1,000. But when the Price of the bond fell to ₹9500, then even in such a situation the interest that will be received is still ₹1,000. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... Bond yield vs coupon rate: Why is RBI trying to keep yield down? For example, if the price of the 10-year bond with fave value of Rs 1,000 and coupon rate of 6 per cent falls to Rs 600 in the secondary market, it will still fetch the interest of Rs 60 per year... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples . Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest payments of $15. If the … What Is Coupon Rate and How Do You Calculate It? - SmartAsset The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 purchase. Other Types of Yields That Bonds Pay. Besides coupon and current yields, there are ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Bond's price is calculated by considering several other factors, including: Bond's face value Current Yield of a Bond - Meaning, Formula, How to Calculate? This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. For instance, a bond with a face value (par value) of $750, trading at $780, will reflect that the bond is trading at a premium of $30 ($780-750). read more. Suppose B is trading at a premium, meaning the current market price is greater than the face value. In this case, the current yield on a …

Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary:

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. For instance, say a bond at issuance is priced at 100 with 10% coupons. You pay 100 initially and receive 10% coupons over the life of the bond.

Coupon Rate vs Yield for a Bond: Fixed Income 101: Easy Peasy ... - YouTube This video addresses "Coupon Rate vs Yield" for a Bond in a simple, kid-friendly way. PLEASE SUBSCRIBE (It's FREE!): ...

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ...

Understanding Bond Prices and Yields - Investopedia A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Although a bond's coupon...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price.

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Current Yield vs. Yield to Maturity: What's the Difference? With these two examples, you can see the role a bond's current market price plays in its yields. The ABC 7% bond is selling at a premium to the $1,000 face value, likely because the coupon rate of 7% is much higher than current interest rates. So the current yield is lower than the coupon payment.

How are bond yields different from coupon rate? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Difference Between Current Yield and Coupon Rate Now the current market price of bonds is $1800, so the current yield can be calculated, which results in the current yield equals to 8.33%. The Current Yield can be equal to the coupon rate in some rare cases when a bond market price gets equal to its face value.. It is higher when the bond market price gets lower than its face value, and it is lower when the bond market price is higher than ...

What Is the Coupon Rate of a Bond? - The Balance In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the current price of the bond.

Bond Yield Rate Vs Coupon Rate - TiEcon 2018 A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it normal balance generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity.

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Relationship Between Price, Yield and Duration | Bonds - PFhub Bonds with higher coupon rates have lower convexity, while zero coupon bonds have the highest convexity. The price yield graph of a straight bond always have a positive convexity. The slope of the tangent to the graph will increase when yield decreases. This means that the duration of such a bond will increase as yield decreases. On the other ...

China Government Bonds - Yields Curve 27.09.2022 · The China 10Y Government Bond has a 2.767% yield.. 10 Years vs 2 Years bond spread is 63 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.65% (last modification in August 2022).. The China credit rating is A+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 110.98 and implied probability …

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![Difference Between Current Yield and Coupon Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2021/03/38.jpg)

Post a Comment for "43 bond yield vs coupon rate"