45 how to calculate coupon rate from yield

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... YIELD function (DAX) - DAX | Microsoft Docs $\text{E}$ = number of days in the coupon period. If there is more than one coupon period until redemption, YIELD is calculated through a hundred iterations. The resolution uses the Newton method, based on the formula used for the function PRICE. The yield is changed until the estimated price given the yield is close to price.

How to Calculate Yield to Call (With Definition and Example) Assuming the bond issuer pays a coupon rate of 10% annually, multiply it by the bond's face value, which is $1,000, to find the coupon payment. Considering that 10% is 10/100, you can multiply it by $1,000 to get an annual coupon payment of $100. $900 = (100 / 2) x { (1 - (1 + YTC / 2) ^ -2t) / (YTC / 2)} + (CP / (1 + YTC / 2) ^ 2t) 3.

How to calculate coupon rate from yield

› current-yield-of-a-bondCurrent Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin, The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -, Coupon Rate = 5-Year Treasury Yield + .05%, Bond coupon rate formula - AhranMaiya For the coupon amount you would. Coupon Rate Annual Coupon Par Value of Bond. The formula to calculate the coupon rate of a bond is. Find the bond yield if the bond price is 1600. A bond with a face value of 100 and a maturity of three years comes with a coupon rate of 5 paid annually. Issued a new four-year bond with a face value of 100 and an ...

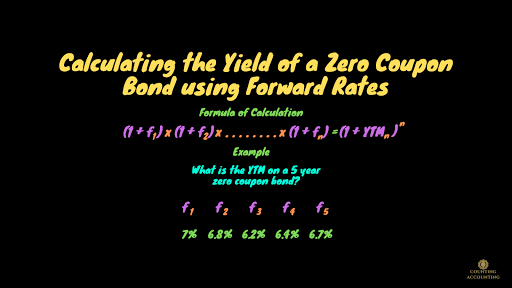

How to calculate coupon rate from yield. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the ... How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Effective yield calculator - LoriannaNirman Annual percentage yield APY is the effective annual rate or real rate of return of an investment if the interest earned each period is compounded. The calculator uses the following formula to calculate the current yield of a bond. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute.

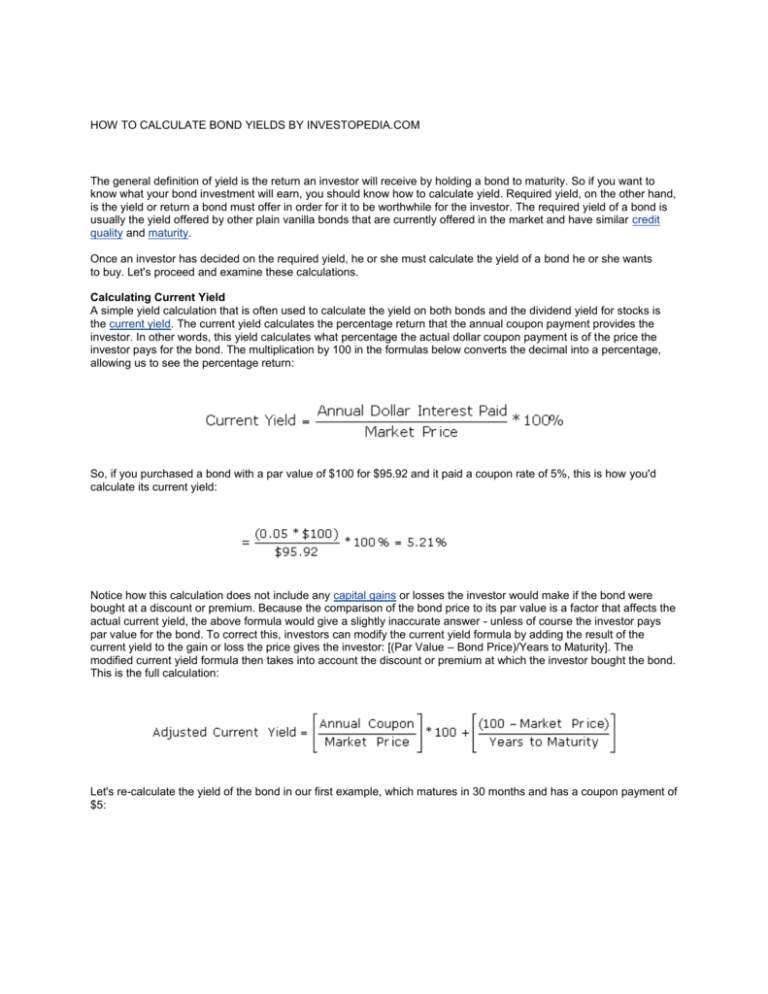

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond.... How to Calculate Current Yield (Formula and Examples) Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100, How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel.

Bond Current Yield Calculator - CalCon Calculator The current yield of a bond is the annualized return on that bond. It's calculated by dividing the coupon payment by the price of the bond. Example: let's say you buy a $1,000 Treasury bill with a 3% coupon and six-month maturity. If you sell this bill at its par value ($1,000), then your current yield will be 6%. Yield - Definition, Overview, Examples and Percentage Yield Formula The average yield of stocks on the S&P 500, for example, typically ranges between 2.0 - 4.0%. Percent Yield Formula. The percent yield formula is a way of calculating the annual income-only return on an investment by placing income in the numerator and cost (or market value) in the denominator. Percentage yield formula: Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1, Where: i - The nominal interest rate on the bond, n - The number of coupon payments received in each year, Practical Example, Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

How to Calculate Yield to Call (YTC): Definition, Formula & Example The bond has a 6% interest rate and an annual coupon of $60. Plugging all of the information into the formula would give Susan: ... How to Calculate Yield to Call (YTC): Definition, Formula ...

YIELD Function - Formula, Examples, Calculate Yield in Excel Yield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return. Formula, = YIELD (settlement, maturity, rate, pr, redemption, frequency, [basis]) This function uses the following arguments: Settlement (required argument) - This is the settlement date of the security.

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

Nominal Yield: What It Is and How to Calculate It - SmartAsset The nominal yield of a bond is its coupon rate. The coupon rate of a bond is the interest rate the issuer guarantees to investors for the duration of the bond term. Coupon rates are fixed and don't change over the life of the bond. Nominal yield is also referred to as nominal bond yield, coupon yield or nominal rate.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100, Coupon Rate = 100 / 500 * 100 = 20%, Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds, Bonds pay interest to their holders.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

How To Calculate Dividend Yield - Forbes Advisor To calculate dividend yield, all you have to do is divide the annual dividends paid per share by the price per share. For example, if a company paid out $5 in dividends per share and its shares ...

› how-to-calculate-yield-toHow to calculate yield to maturity in Excel (Free ... - ExcelDemy Sep 14, 2022 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate, Where: C = Coupon rate, i = Annualized interest, P = Par value, or principal amount, of the bond, Download the Free Template, Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond, All types of bonds pay interest to the bondholder.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate Template - Realonomics The coupon rate can be considered as the yield on a fixed-income security. ... To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. How do I calculate current yield? Calculating Current Yield.

Bond coupon rate formula - AhranMaiya For the coupon amount you would. Coupon Rate Annual Coupon Par Value of Bond. The formula to calculate the coupon rate of a bond is. Find the bond yield if the bond price is 1600. A bond with a face value of 100 and a maturity of three years comes with a coupon rate of 5 paid annually. Issued a new four-year bond with a face value of 100 and an ...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin, The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -, Coupon Rate = 5-Year Treasury Yield + .05%,

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

› current-yield-of-a-bondCurrent Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest.

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "45 how to calculate coupon rate from yield"