38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

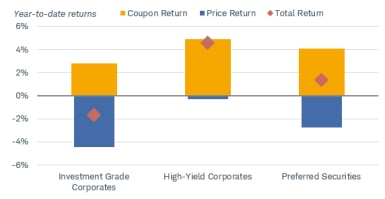

What Happens When a Bond Matures? - Debt Quest The market values of bonds are deemed volatile because they can be traded even before their maturity. For example, an issued bond at $1000 given a 7% yield initially means that both the current and the nominal yield are at 7%. If the investor later trades off the bond at $900, there is an increase in current yield amounting to 7.8% ($7 or $900). Mcq Bmc - Vsip.info 8 0 65KB Read more. mcq cpr. MCQ on CPR Choose the best answer, multiple selections may be possible, time 25 minutes, Full marks 20 1. ... If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A- No, the price goes up, the yield goes up B- Yes, the price goes down, the yield goes up C- No, the price goes down ...

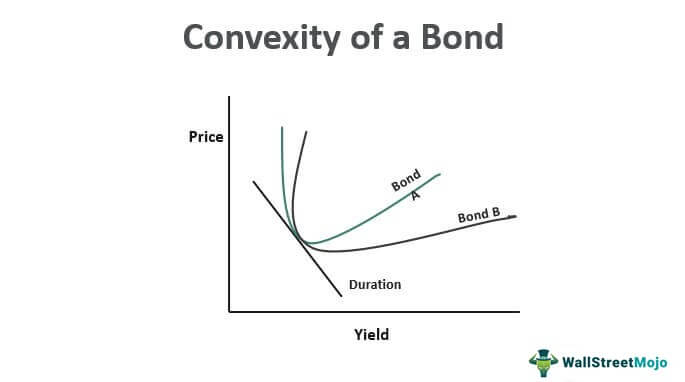

Bond (finance) - Wikipedia At the time of issue of the bond, the coupon paid, and other conditions of the bond, will have been influenced by a variety of factors, such as current market interest rates, the length of the term and the creditworthiness of the issuer. These factors are likely to change over time, so the market price of a bond will vary after it is issued.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

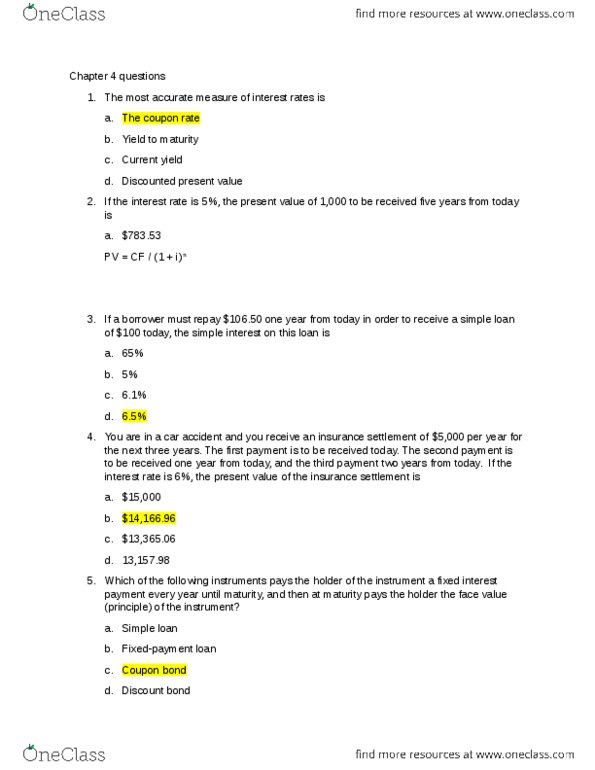

Currencies and Fixed Income Flashcards | Quizlet The lower the agreed purchase price for a bond, the greater the PR or yield. ... Prospective borrows are unhappy as they would have to promise to pay back relatively more to secure a loan. If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down and the payments are fixed ... Why Do Bond Prices Go Down When Interest Rates Rise? - The Balance Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%. Because buyers can now purchase a $1,000 bond with $20 six-month coupon payments, your $15 coupon payment doesn't look so great. New bond: The buyer would receive $40 yearly for 10 years for a total of $400. Why does the borrower pay more interest if the yield on a fixed coupon ... The borrower does not pay more interest in a fixed coupon, even if the yield goes up. Essentially, if the yield goes up, it means that the market price has gone down, below the face value (or earlier market value) of the bond. If a bond is issued at 100 and coupon is 4 annually, yield is 4% p.a..

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Later, Investor B buys the bond for $900 as the market has heated up and a safe instrument has lost value. Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield ... Bonds and the Yield Curve | Explainer | Education | RBA This Explainer has two parts: The first part outlines the concept of a bond and a bond yield. It also discusses the relationship between a bond's yield and its price. The second part explains how the yield curve is formed from a series of bond yields, and the different shapes the yield curve can take. It then discusses why the yield curve is an ... Knowledge Check.docx - 1) What do the red bars at the... Because it has the right to tax the wealthiest population on earth 6) If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A. No, the price goes down. The payments are fixed B. Yes, the price goes up. The yield goes down C. No, the price goes up. The yield goes up D. Yes, the price goes down. What Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Coupon rate: The nominal or stated rate of interest on a fixed-income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond’s face value. These interest payments are usually made semiannually. Issue date: The issue date is the date on which a bond is issued and begins to accrue interest. Maturity ...

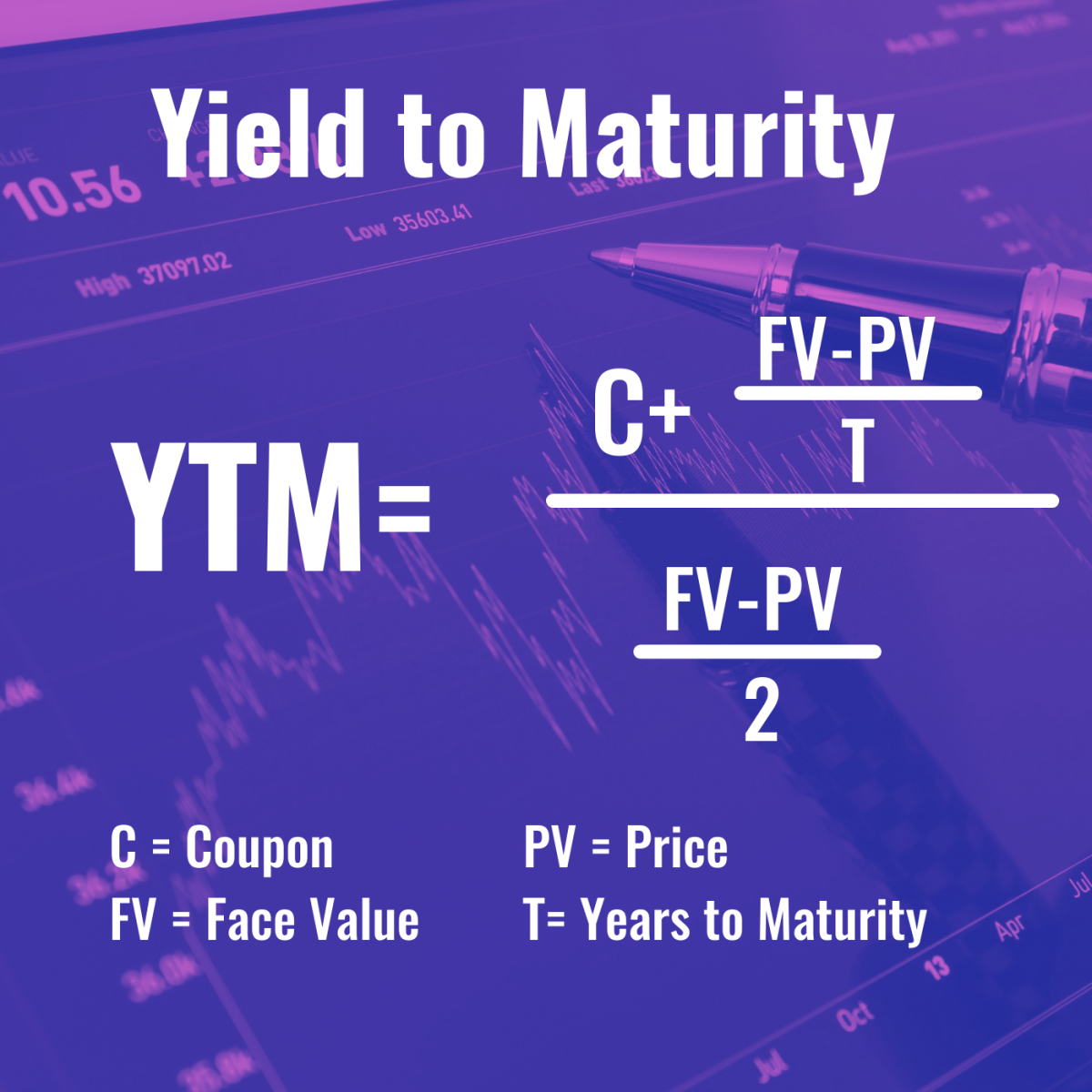

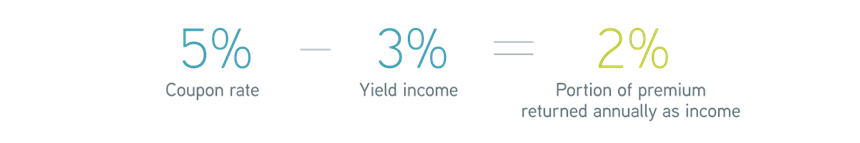

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Investing Flashcards - Quizlet If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. ... 4,000 million Peruvian sol. Which one of the following actors benefits when interest rates go up? An investor who is about to buy bonds. ... The bond with the highest yield if the two bonds have the same maturity date. Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo The interest rate does not depend on the issue price or market value; it is already being decided by the issuing party. The market interest rates have effects on the bond prices and yield, wherein the increase in the market interest rates will reduce the fixed-rates of the bond. Coupon Rate vs. Interest Rate Infographics Solved KNOWLEDGE CHECK If the yield on a fixed-coupon bond | Chegg.com Question: KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. The yield goes down No, the price goes up. The yield goes up. No, the price goes down. The payments are fixed. Yes, the price goes down. The coupon payments go up. This problem has been solved! See the answer

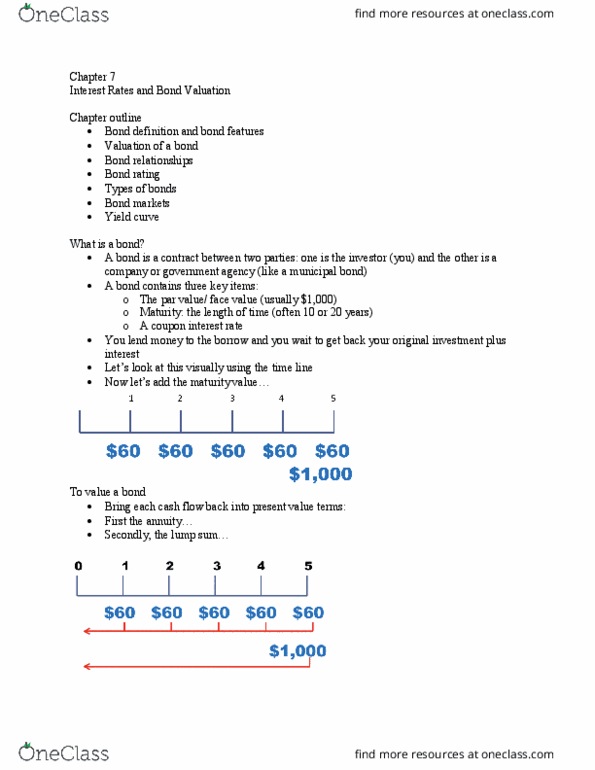

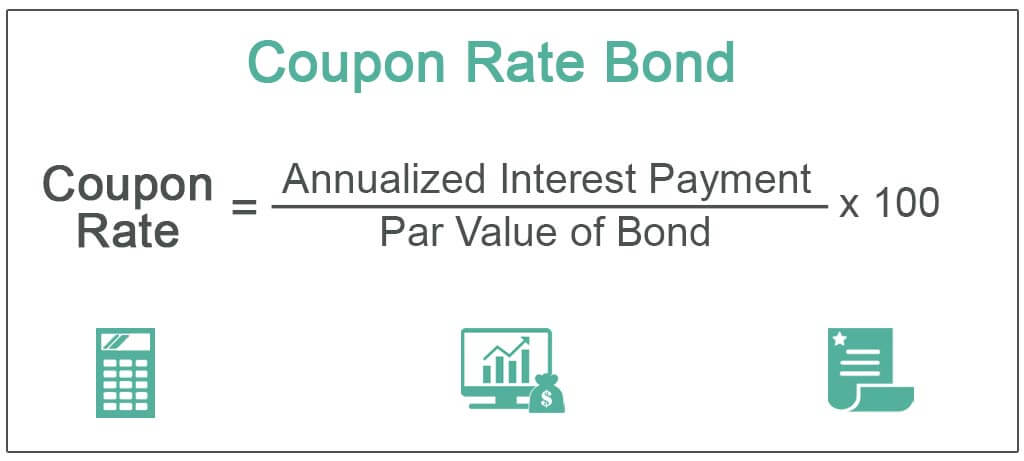

Coupon Rate of a Bond - WallStreetMojo Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market.

Increase in bond yields: Impact on investors - Financialexpress The increase in bond yield is attributable to high inflation, growing fiscal, trade deficit. As companies/ government issues bonds to raise money, they pay a fixed interest known as coupon rate ...

PDF Investor BulletIn Interest rate risk — When Interest rates Go up ... rates fall to 2%. The bond will still pay a 3% coupon rate, making it more valuable than new bonds paying just a 2% coupon rate. If you sell the 3% bond before it matures, you will probably find that its price is higher than it was a year ago. Along with the rise in price, however, the yield to maturity of the bond will go down for anyone who ...

If the yield on a fixed coupon bond goes up, does the borrower have to ... The borrower does not pay more interest. "…the yield on a fixed coupon bond goes up…" means that the price of the bond declines. If the borrower borrows $1 billion at a rate of 3%, that means (generally, more-or-less) that the borrower pays $15 million twice per year as interest.

Corporate Bonds - Fidelity A common example is the "survivor's option," whereby if the owner of the bond dies, the heirs have the ability to put back the bond to the issuer and typically receive par value in return. Step-up Interest on step-up securities is paid at a fixed rate until the call date, at which time the coupon increases if the bond is not called. Step-down

(Solved) - If the yield on a fixed-coupon 'bond goes up, does the ... If the yield on a fixed-coupon ...

At Par - Overview, Bond Yields and Coupon Rates, Importance The coupon rate can be defined as the interest rate it yields. Par values are generally fixed at 100, in lieu of 100% of the face value of the $1,000 bond. So, when a bond is quoted or said to be trading at 100, it means that the bond is trading at 100% of its par value, which is $1,000. However, if a bond is said to be trading at 85, it means ...

Solved If the yield on a fixed-coupon 'bond goes up, does - Chegg Expert Answer 99% (352 ratings) Option d is the correct option No … View the full answer Transcribed image text: If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If the coupon rate on a bond is higher than its yield, the bond will be trading at a premium. This is because the fixed rate of interest on the bond exceeds prevailing interest rates; therefore,...

D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg - KNOWLEDGE CH... View D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg from AE MISC at Wilmington University. KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more interest? Yes,

(Solved) - KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up ... No, the price goes down. The ...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

If the yield on a fixed-coupon 'bond goes up, does the...ask 5 LG 5 P6-16 Bond valuation: Annual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest annually Bond Par value Coupon interest rate Years to maturity Required return 12% 14% $1,000 16 1,000 100 500 13 1,000

4. BONDS & FIXED INCOME — Investopedia 0.0.1 documentation The bond yield can be defined in different ways. Setting the bond yield equal to its coupon rate is the simplest definition. The current yield is a function of the bond's price and its coupon or interest payment, which will be more accurate than the coupon yield if the price of the bond is different than its face value.

Glossary - Common Fidelity Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ...

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon payments remain static. 2 For instance, a...

What is a Bond? | Categories, Characteristics, Price, Varieties, Benefits When interest rates decrease the bond prices will rise to have an equalizing effect on the interest rate of the bond. For example - a 10% coupon rate, a $1000 bond is issued, and the price goes down to $800. The yield will go up to 12.5% this is since you are guaranteed $100 on an asset that is now worth $800.

Why does the borrower pay more interest if the yield on a fixed coupon ... The borrower does not pay more interest in a fixed coupon, even if the yield goes up. Essentially, if the yield goes up, it means that the market price has gone down, below the face value (or earlier market value) of the bond. If a bond is issued at 100 and coupon is 4 annually, yield is 4% p.a..

Why Do Bond Prices Go Down When Interest Rates Rise? - The Balance Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%. Because buyers can now purchase a $1,000 bond with $20 six-month coupon payments, your $15 coupon payment doesn't look so great. New bond: The buyer would receive $40 yearly for 10 years for a total of $400.

Currencies and Fixed Income Flashcards | Quizlet The lower the agreed purchase price for a bond, the greater the PR or yield. ... Prospective borrows are unhappy as they would have to promise to pay back relatively more to secure a loan. If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down and the payments are fixed ...

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"