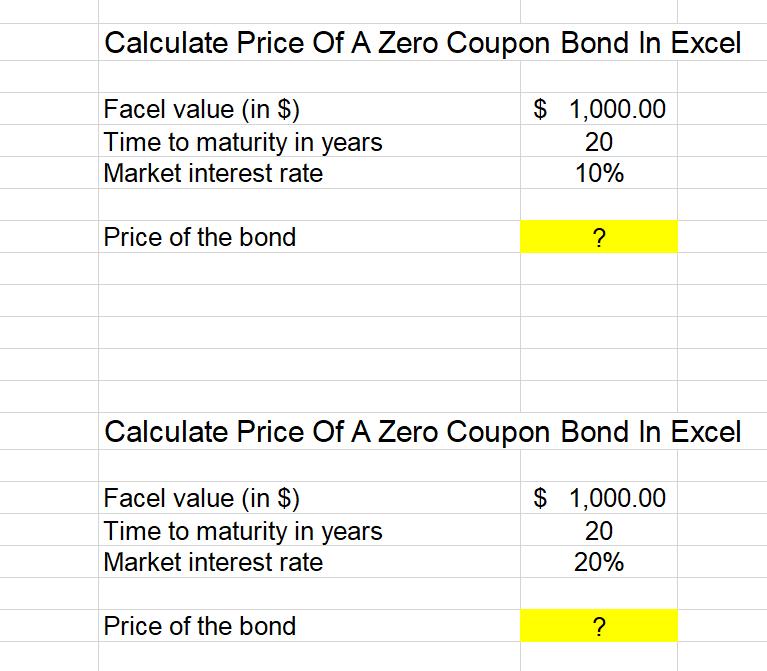

40 calculate price zero coupon bond

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping 16.7.2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return …

Calculate price zero coupon bond

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This can be found by table, by formula, or by use of an Excel spreadsheet 1. Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900. present value = $20,000 × $0.8900. present value = $17,800. Solved Calculate the price of a zero-coupon bond that | Chegg.com Calculate the price of a zero-coupon bond that matures in 24 years if the market interest rate is \ ( 4.1 \) percent. Assume semiannua compounding. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

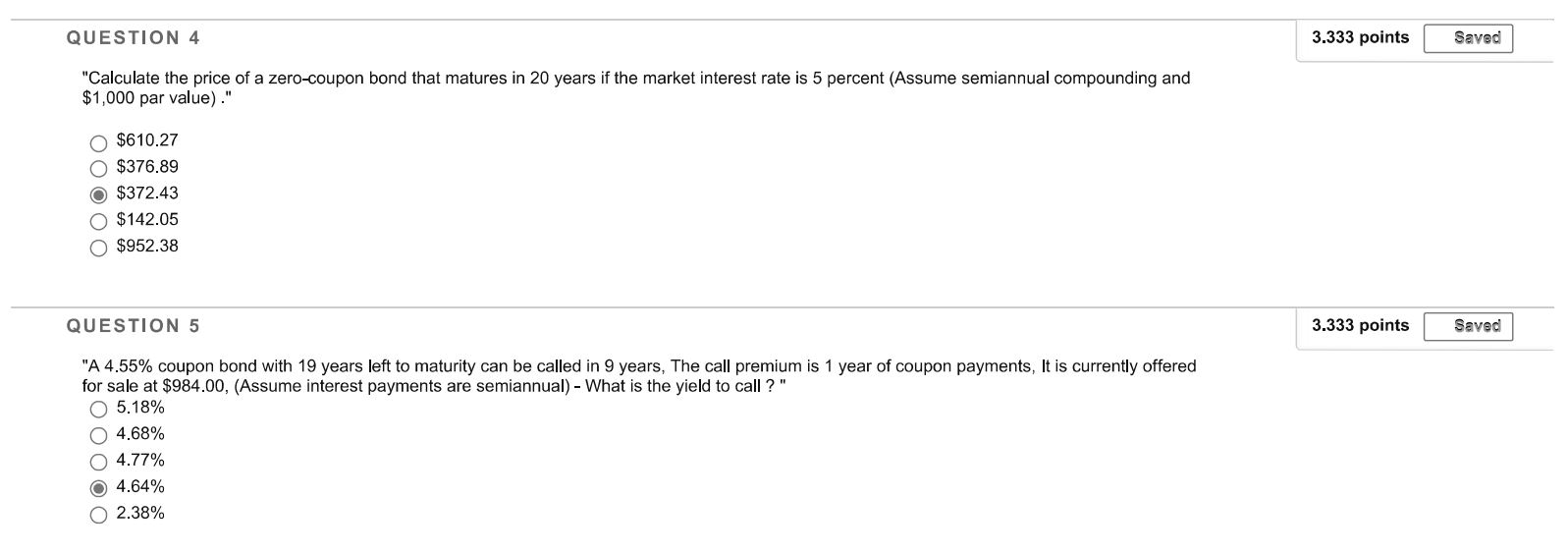

Calculate price zero coupon bond. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero Coupon Bond: Formula & Examples - Study.com A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%... Solved Calculate the price of a zero-coupon bond that - Chegg Expert Answer. 100% (1 rating) value of zero coupon bond = face value / (1+r)^n here, …. View the full answer. Transcribed image text: Calculate the price of a zero-coupon bond that matures in 14 years if the market interest rate is 5.60 percent. Assume semiannual compounding.

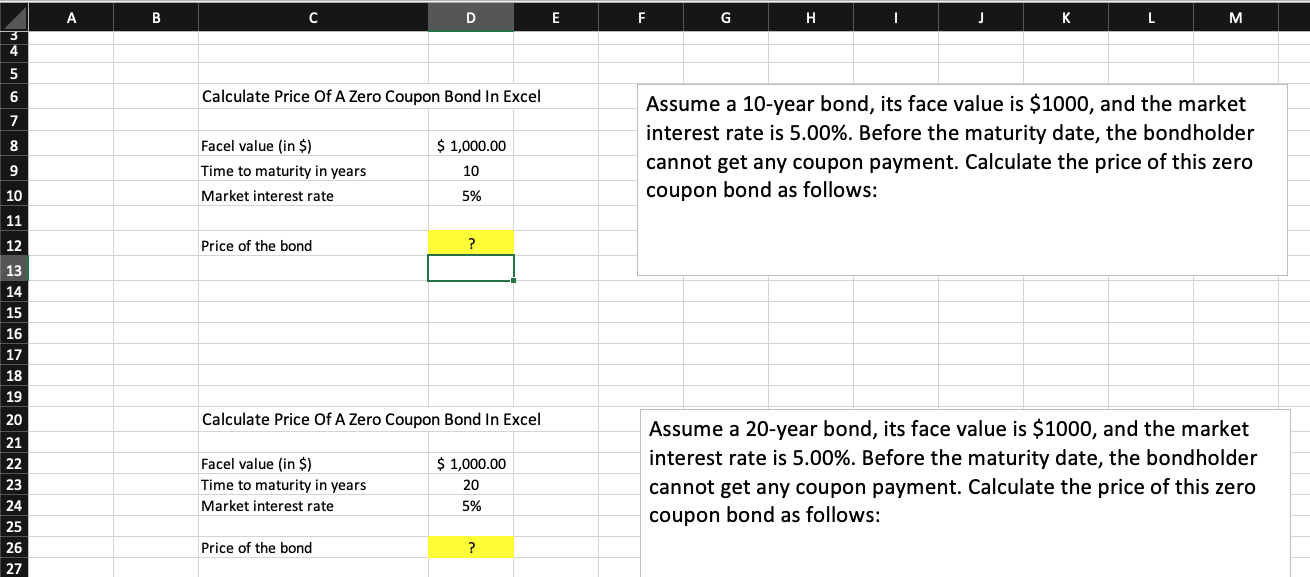

Calculate Zero Coupon Bond Value - calculatoratoz.com To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of …

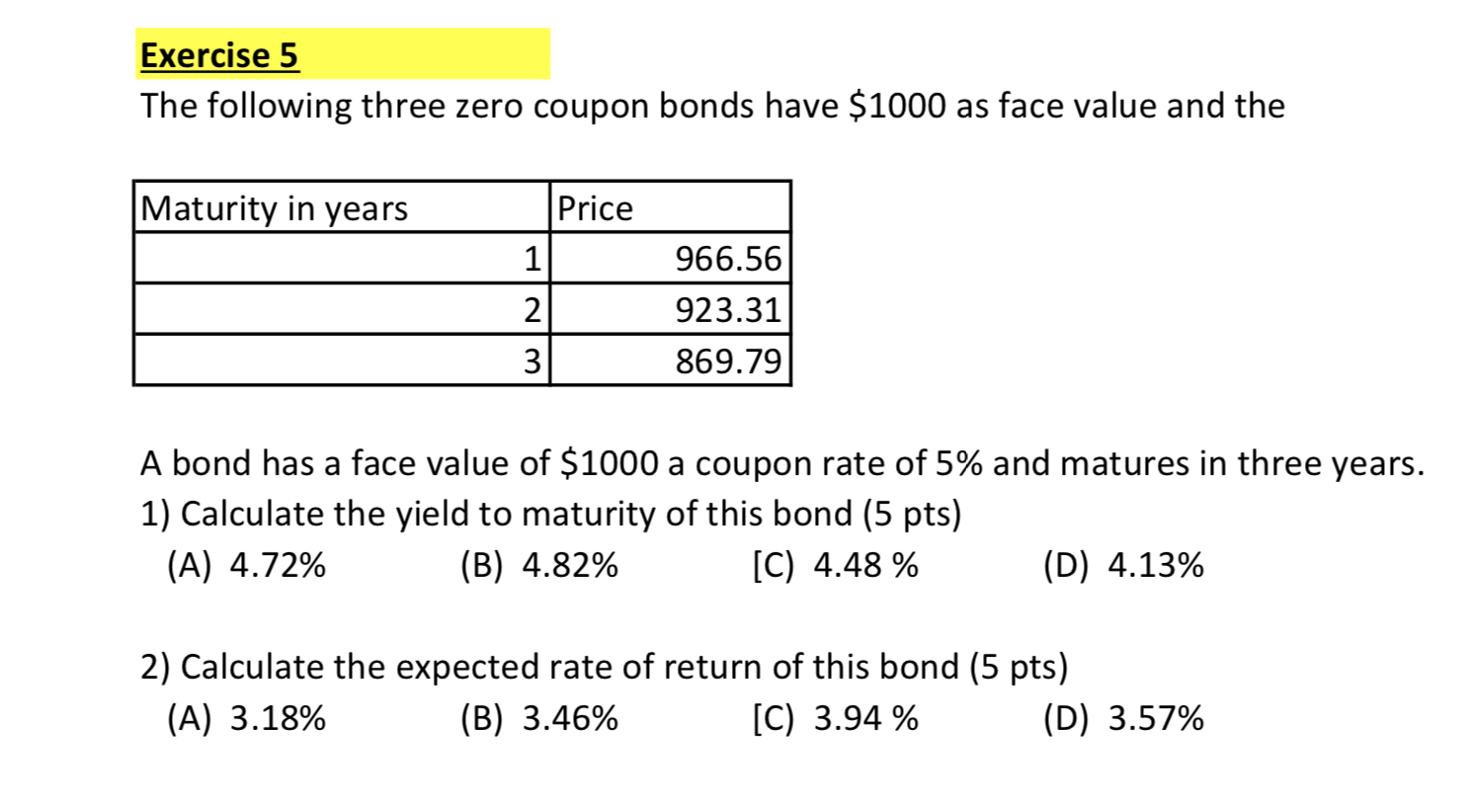

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Calculate Price of Bond using Spot Rates | CFA Level 1 - AnalystPrep Sometimes, these are also called "zero rates" and bond price or value is referred to as the "no-arbitrage value." Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Zero Coupon Bond Value Formula: How to Calculate Value of Zero Coupon Yield to maturity for zero-coupon bonds is calculated as: YTM = \sqrt[n]{ \frac{Face\;value}{Current\;price} } - 1 Example of YTM of a zero-coupon bond calculation. Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is ... Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

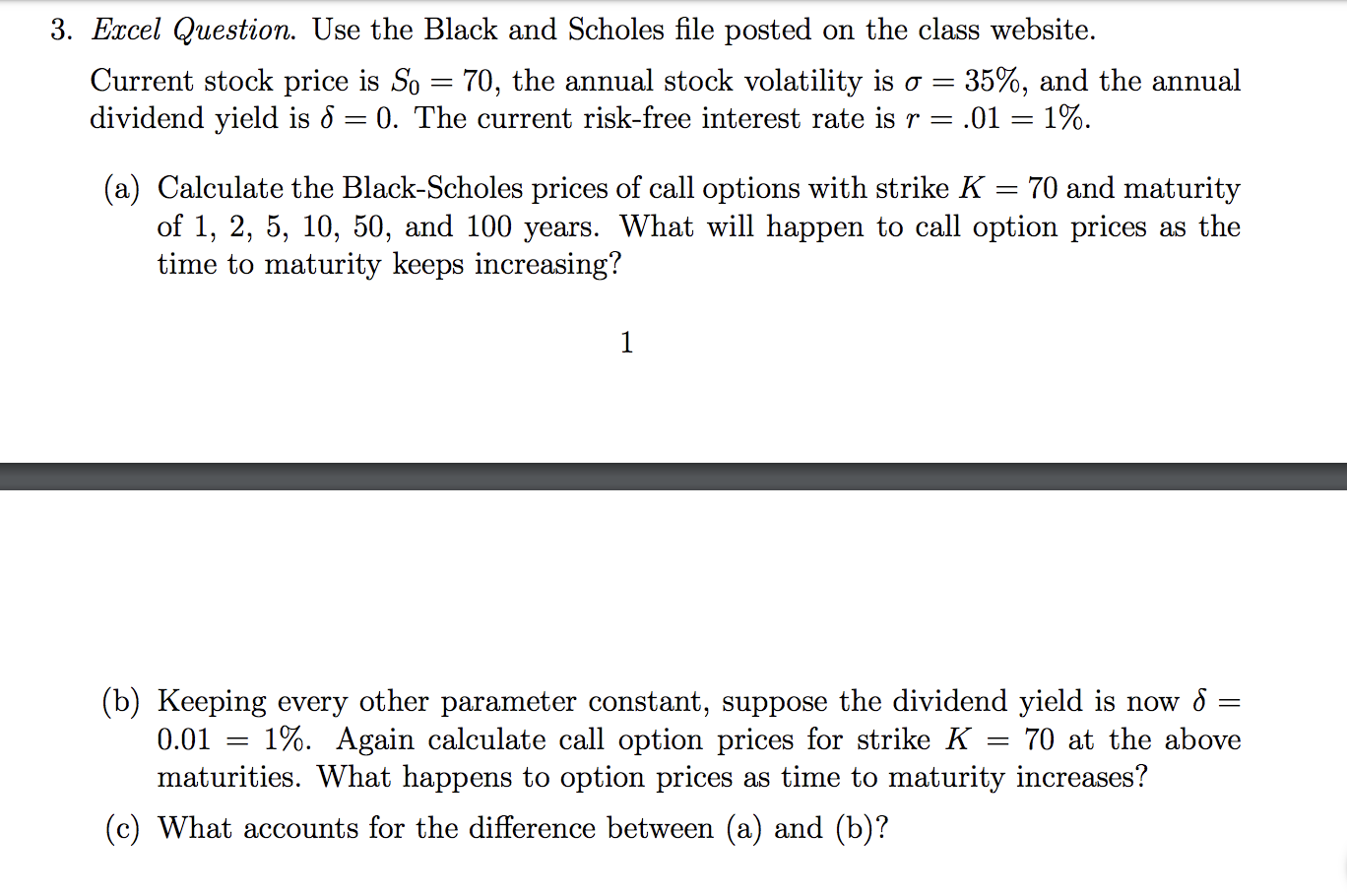

Understanding Bond Prices and Yields - Investopedia 28.6.2007 · As the price of a bond increases or decreases, the true yield will change—straying from the coupon rate to make the investment more or less enticing to investors. All else equal, when a bond's ...

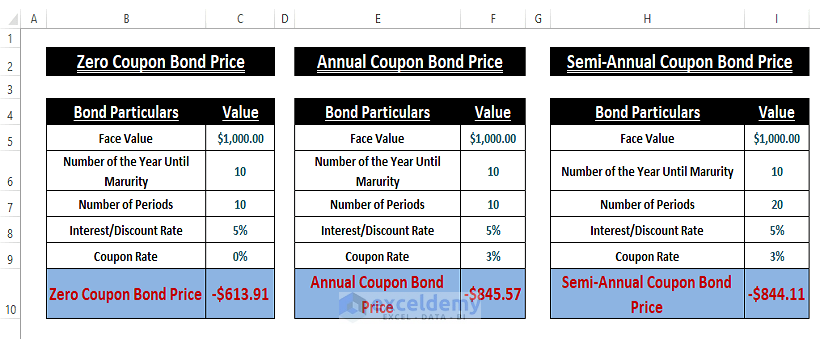

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples)

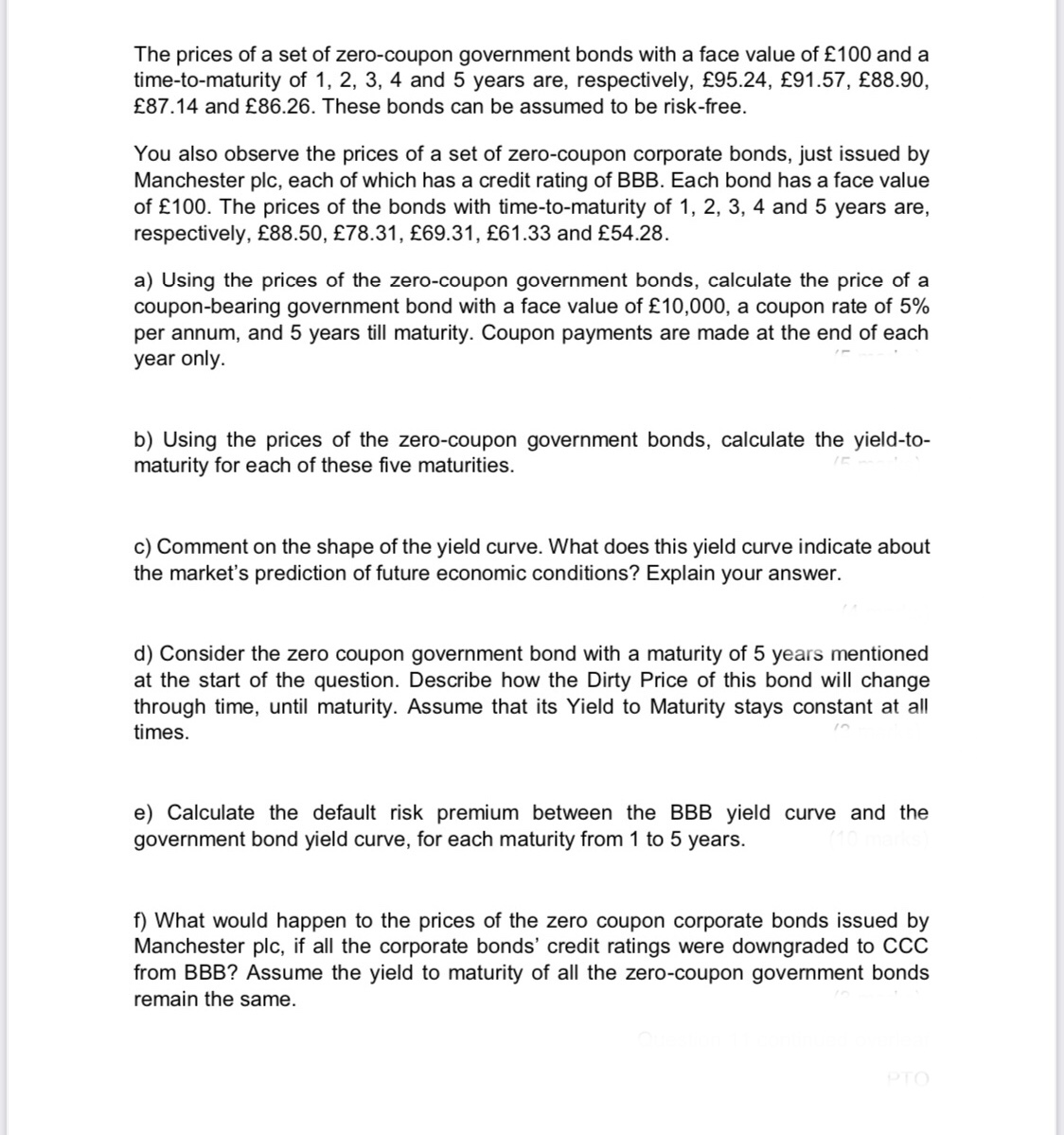

How to Price a Bond Using Spot Rates (Zero Curve) A better way to price the bonds is to discount each cash flow with the spot rate (zero coupon rate) for its respective maturity. Example 1. Let's take an example. Suppose we want to calculate the value of a $1000 par, 5% coupon, 5 year maturity bond. We also have the following spot rates for the next 5 years:

How to Calculate Carrying Value of a Bond (with Pictures) 24.4.2021 · Calculate the carrying value of a bond sold at premium. Suppose a company sold $1,000 10%, 10 year bonds for $1,080 and 2 years have passed since the issue date. Calculate the premium by subtracting the face value from the sale price with the equation $1,000 - $1,080 = $80. The $80 premium will be amortized over the term of the bond at $8 per ...

Write down the formula that is used to calculate the yield to maturity on a twenty-year 12 % coupon bond with a 1,000 face value that sells for 2,500.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. Zero Coupon Bond Value Calculator. Face Value ($): Yield (%): Years to Maturity: Value. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero-Coupon Bond - Definition, How It Works, Formula Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05

How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · With no coupon payments on zero-coupon bonds, their value is entirely based on the current price compared to face value. As such, when interest rates are falling, prices are positioned to rise ...

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Solved Calculate the price of a zero-coupon bond that | Chegg.com Calculate the price of a zero-coupon bond that matures in 24 years if the market interest rate is \ ( 4.1 \) percent. Assume semiannua compounding. (Do not round intermediate calculations and round your final answer to 2 decimal places.)

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This can be found by table, by formula, or by use of an Excel spreadsheet 1. Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900. present value = $20,000 × $0.8900. present value = $17,800.

Post a Comment for "40 calculate price zero coupon bond"