40 coupon rate treasury bond

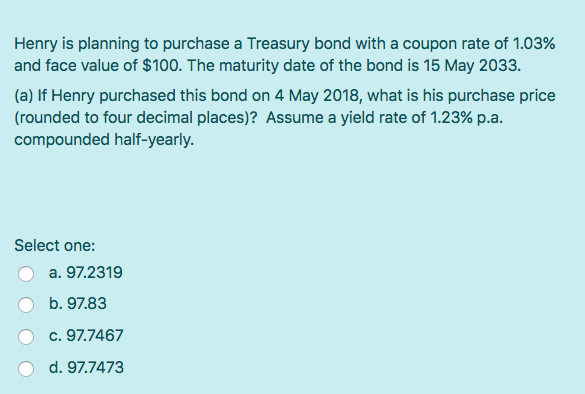

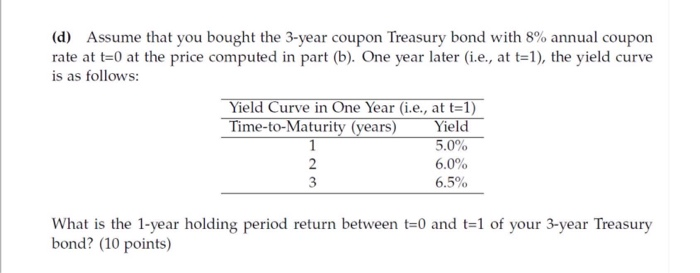

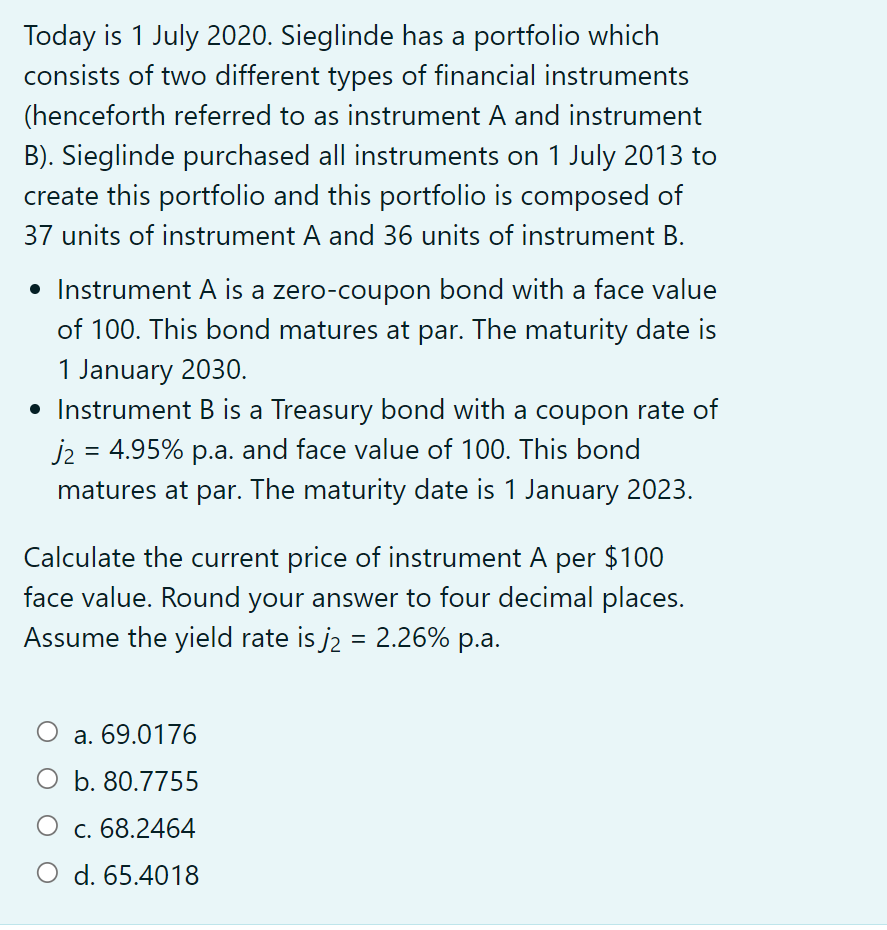

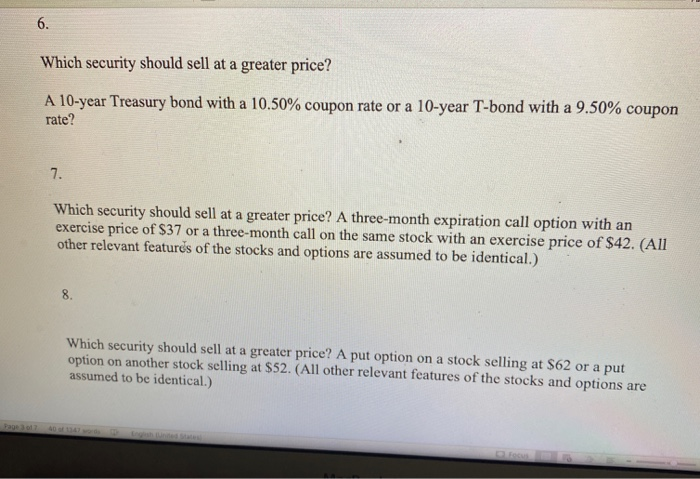

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month .

Coupon rate treasury bond

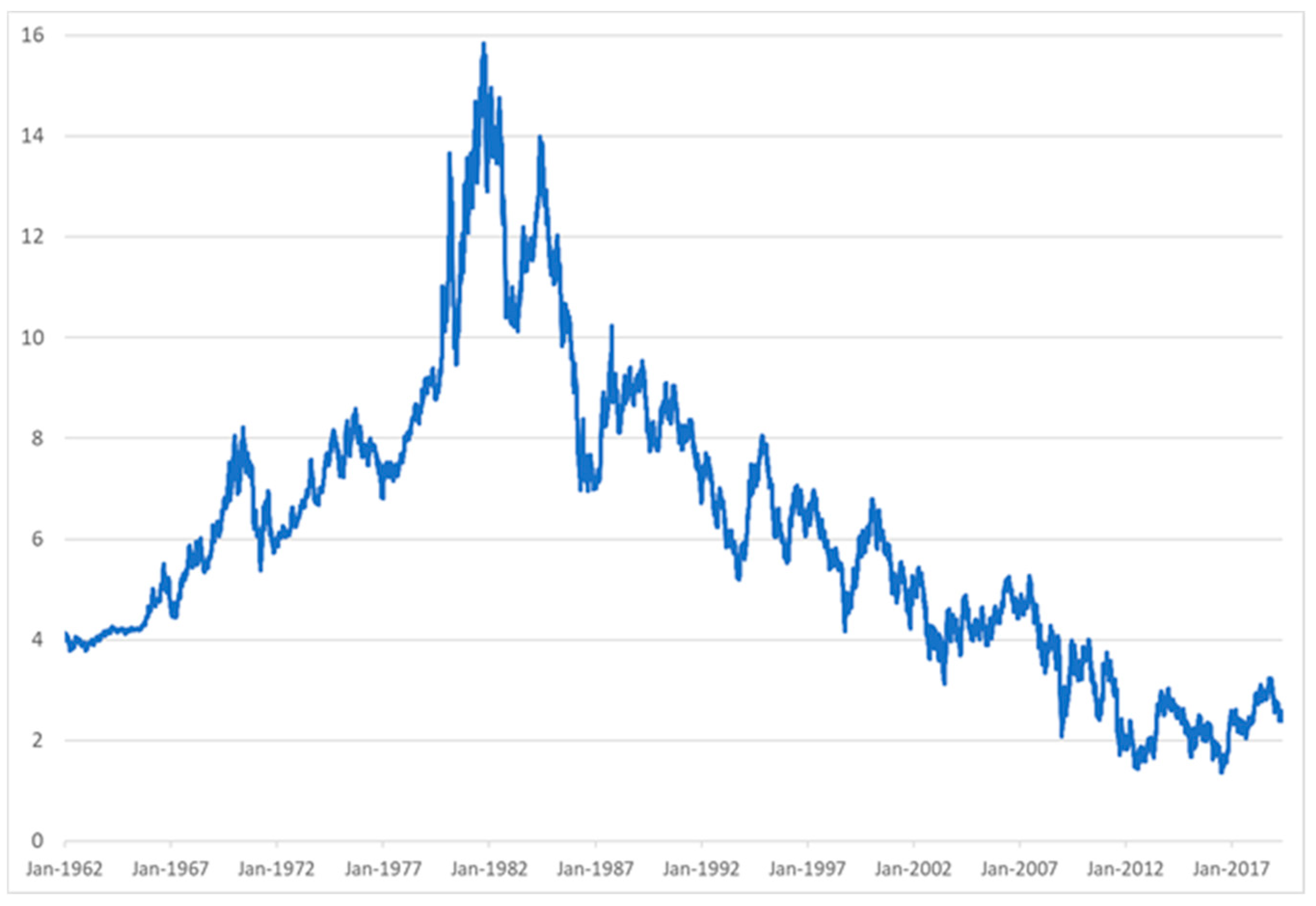

I bonds interest rates — TreasuryDirect Current Interest Rate. Series I Savings Bonds. 6.89%. For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... 30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of November 22, 2022 is 3.83%.

Coupon rate treasury bond. Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. U.S. Treasury Bond Futures Quotes - CME Group 1 day ago · Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures.

Treasury Bonds — TreasuryDirect Interest rate: The rate is fixed at auction. It does not vary over the life of the bond. It is never less than 0.125%. See Interest rates of recent bond auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive ... Issuance of Venezuela-Related General Licenses and Frequently Asked ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America's Finances. Monthly Treasury Statement. Understanding Pricing and Interest Rates — TreasuryDirect The interest rate of an FRN changes, or "floats," over the life of the FRN. The interest rate is the sum of two parts: an index rate and a spread. Index rate - The index rate of your FRN is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week bill every week, so the index rate of an FRN ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ... Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. ZROZ: Should Have 'First-Mover Advantage' When Treasury Rates Peak ZROZ is run by bond giant PIMCO. It aims to profit from the total return on the longest-term U.S. Treasury Bonds whose coupon payments are "stripped out," otherwise known as Zero Coupon Bonds. The ...

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

I bonds — TreasuryDirect Compare I savings bonds to TIPS (Treasury's marketable inflation-protected security) Current Interest Rate. Series I Savings Bonds. 6.89%. For savings bonds issued November 1, 2022 to April 30, 2023. ... We list interest rates for all I bonds ever issued in 2 ways: Matrix showing fixed rates, inflation rates, and combined rates together (PDF)

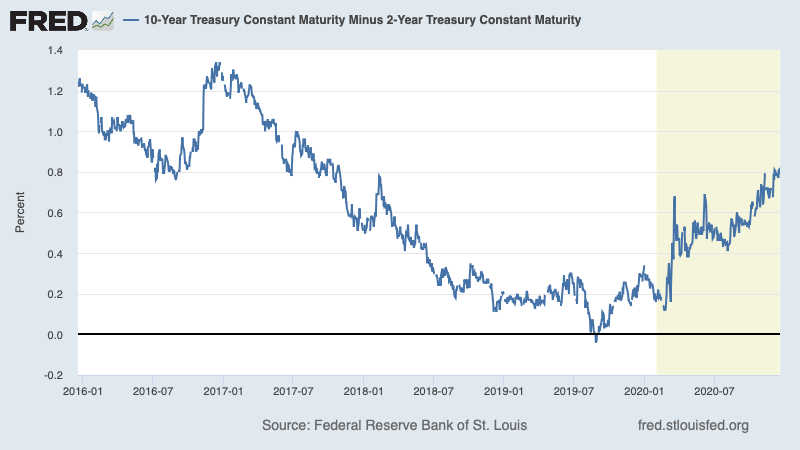

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Continued Treasury Zero Coupon Spot Rates — TreasuryDirect 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the Selected Asset and Liability Price Report under Spot (Zero Coupon ...

Floating Rate Bond ETF (USFR) Hits New 52-Week High For investors seeking momentum, WisdomTree Floating Rate Treasury Fund (USFR Quick Quote USFR - Free Report) is probably on radar. The fund just hit a 52-week high and is up 0.4% from its 52-week ...

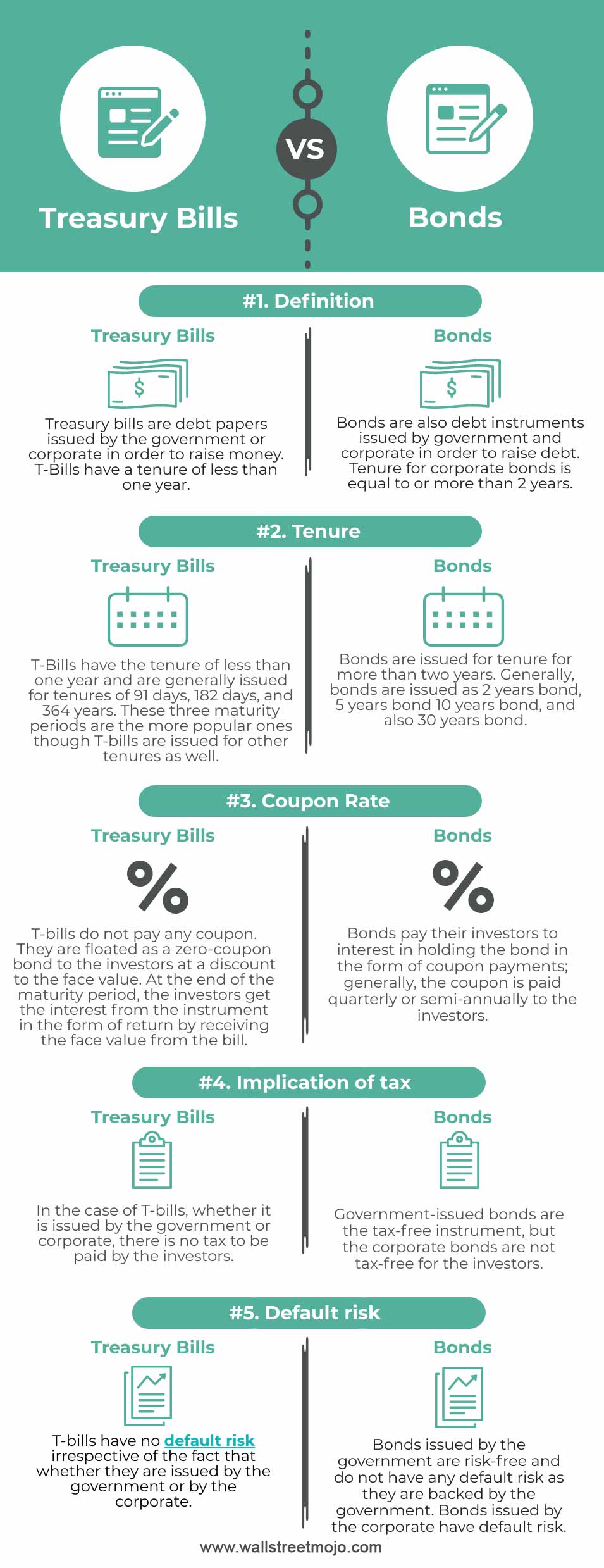

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 3 percent coupon rate. That means the bond will pay $30 per year for every $1,000 in face value (par value) that you own. So the semiannual ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of November 22, 2022 is 3.83%.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

I bonds interest rates — TreasuryDirect Current Interest Rate. Series I Savings Bonds. 6.89%. For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Post a Comment for "40 coupon rate treasury bond"