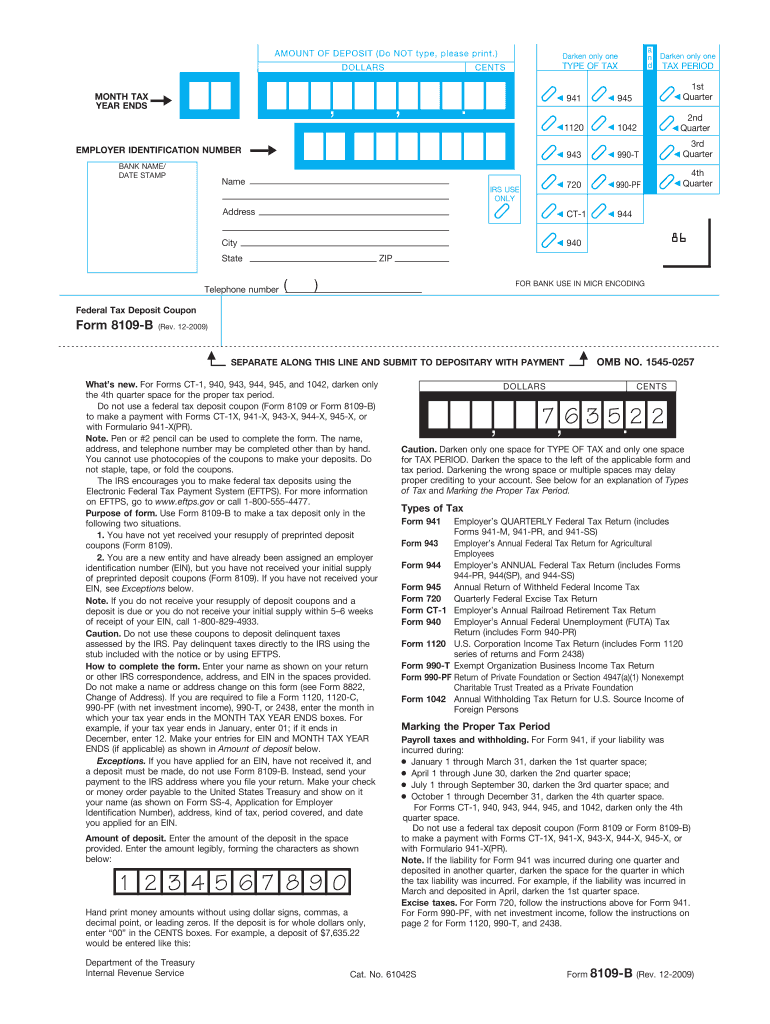

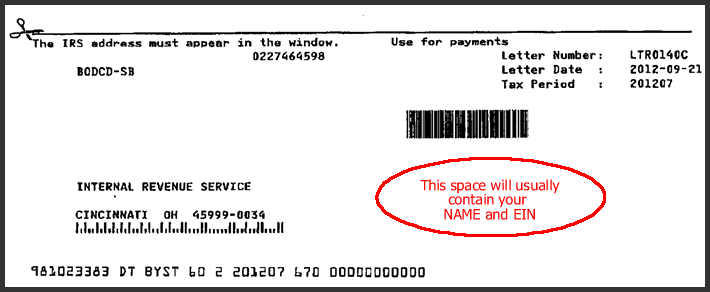

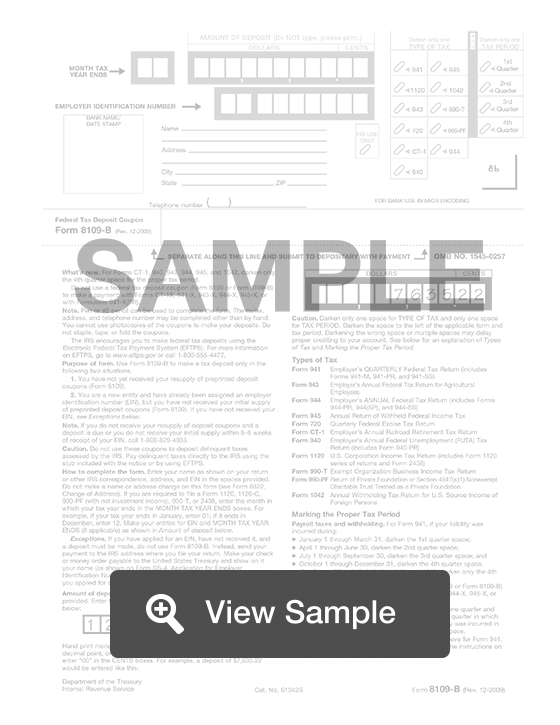

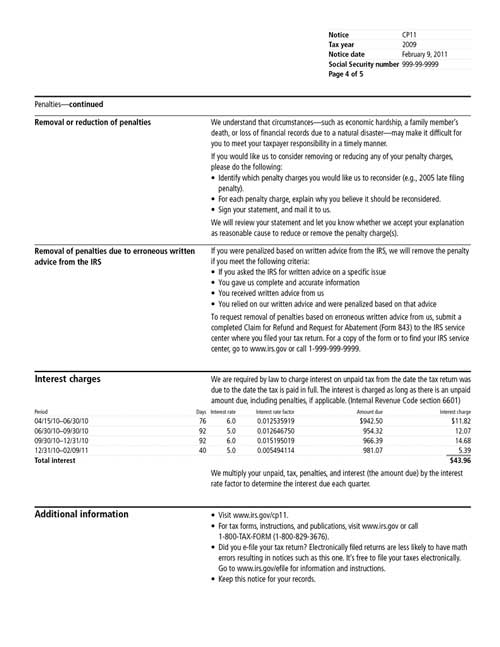

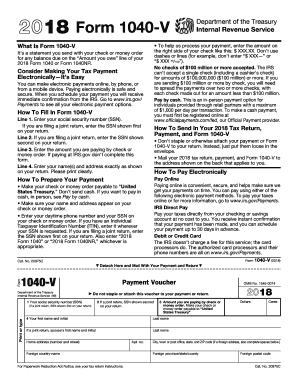

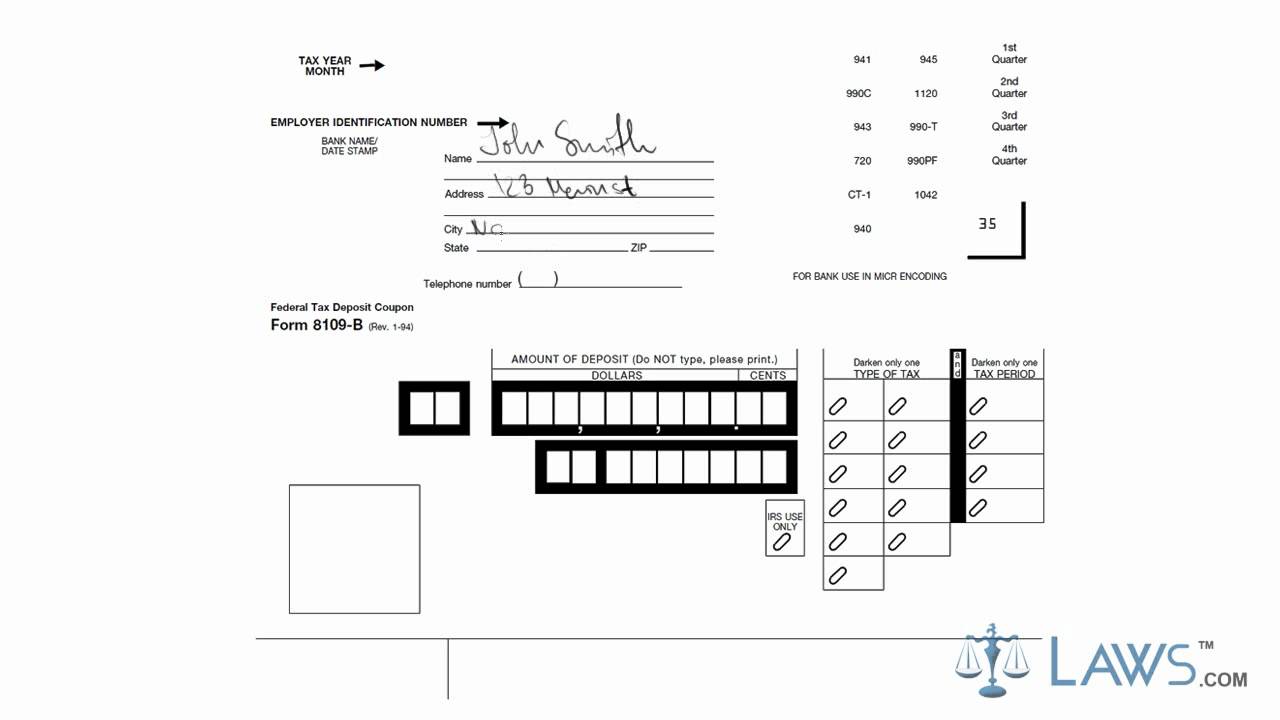

41 payment coupon for irs

› irb › 2004-33_IRBInternal Revenue Bulletin: 2004-33 - IRS tax forms Aug 16, 2004 · Q-19. A health plan which otherwise qualifies as an HDHP generally requires a 10 percent coinsurance payment after a covered individual satisfies the deductible. However, if an individual fails to get pre-certification for a specific provider, the plan requires a 20 percent coinsurance payment. › publications › p15Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ...

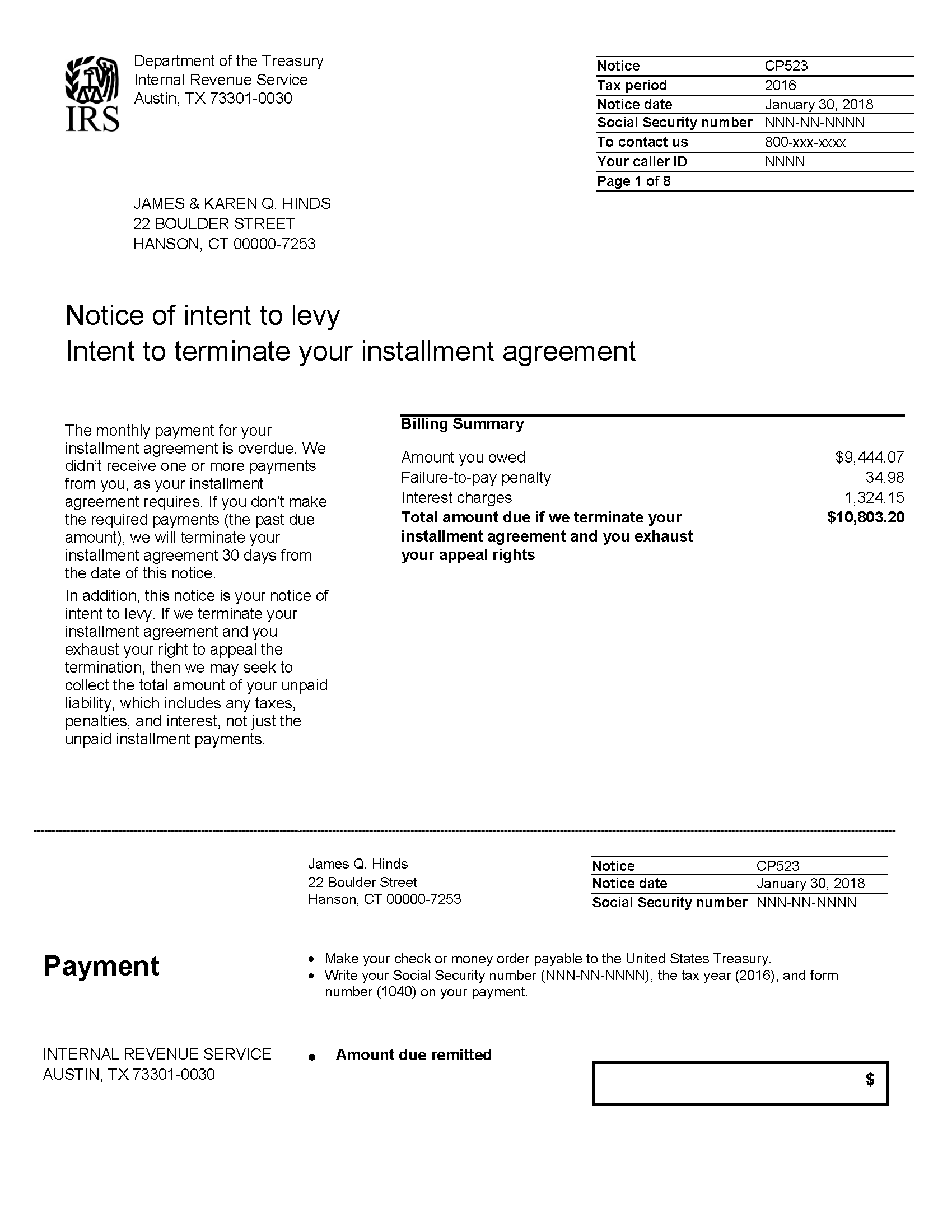

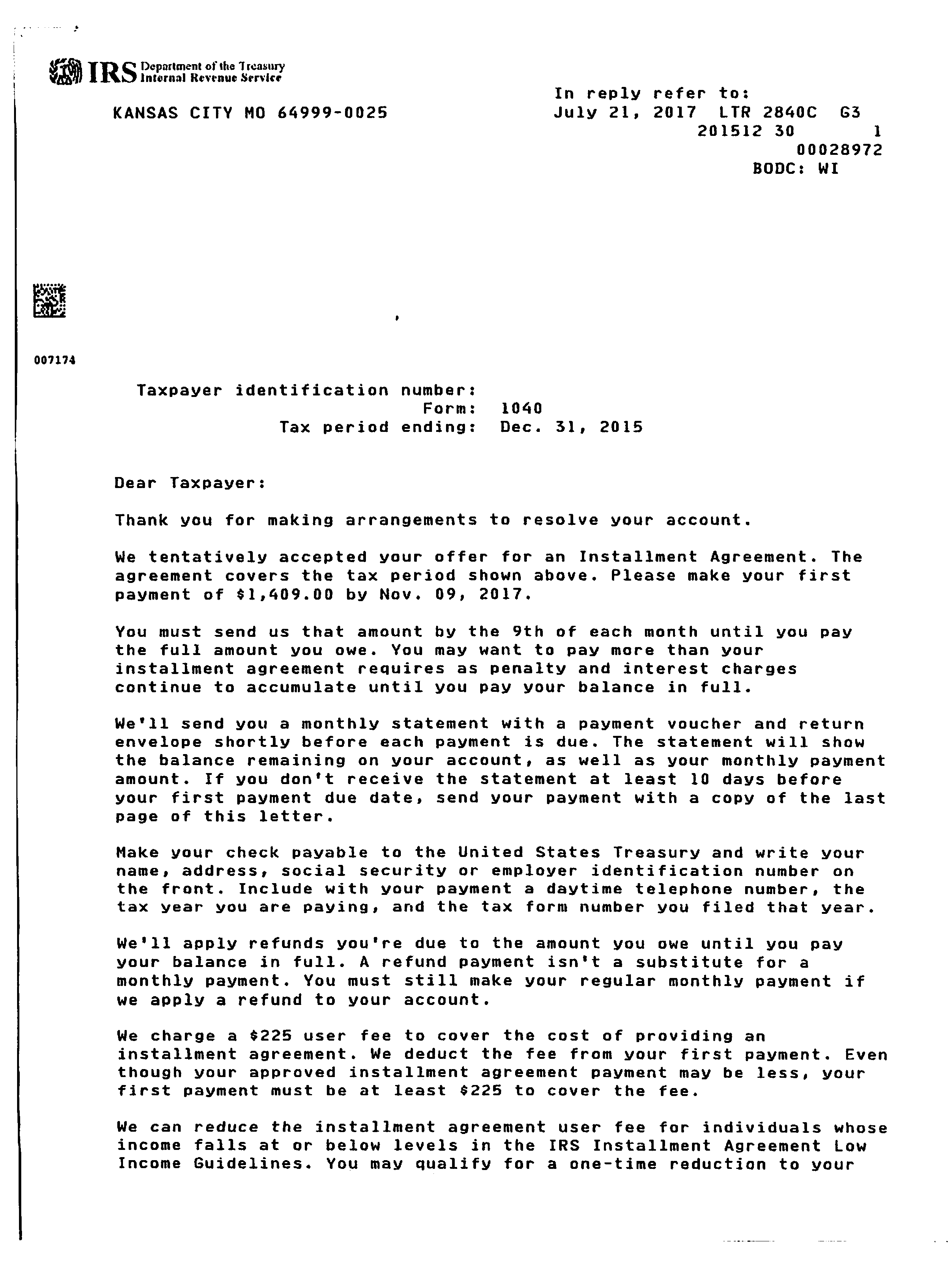

› instructions › i706Instructions for Form 706 (09/2022) | Internal Revenue Service Time for payment. Under the installment method, the executor may elect to defer payment of the qualified estate tax, but not interest, for up to 5 years from the original payment due date. After the first installment of tax is paid, you must pay the remaining installments annually by the date 1 year after the due date of the preceding installment.

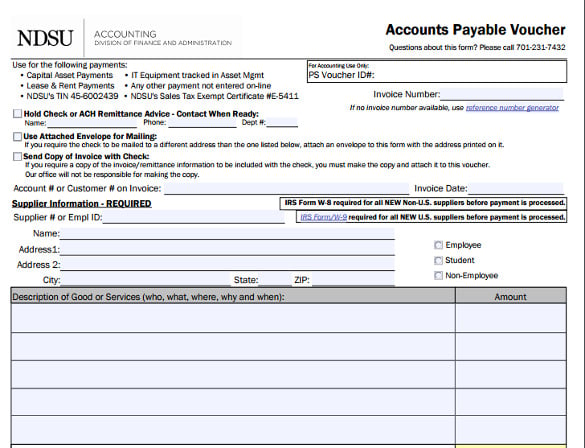

Payment coupon for irs

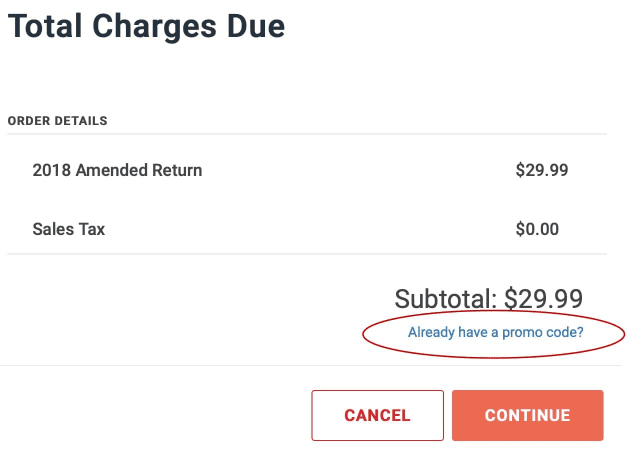

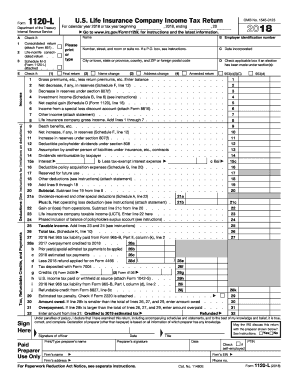

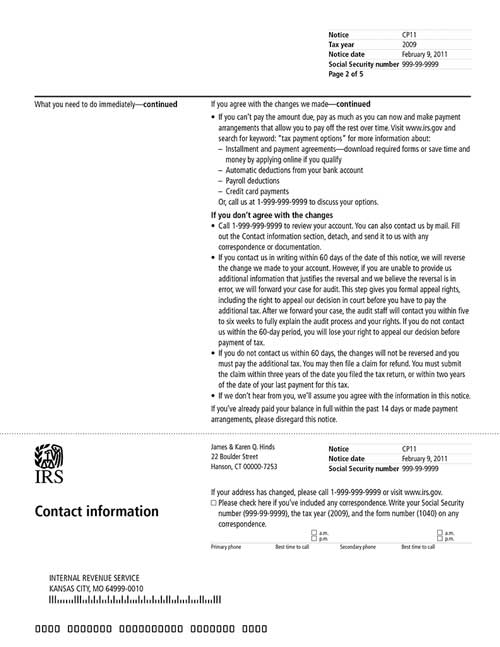

› payPayments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. › filing › free-file-do-your-federalIRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. › forms-instructions-and-publicationsForms, Instructions and Publications | Internal Revenue Service The latest versions of IRS forms, instructions, and publications. View more information about Using IRS Forms, Instructions, Publications and Other Item Files. Click on a column heading to sort the list by the contents of that column. Enter a term in the Find box; Click the Search button

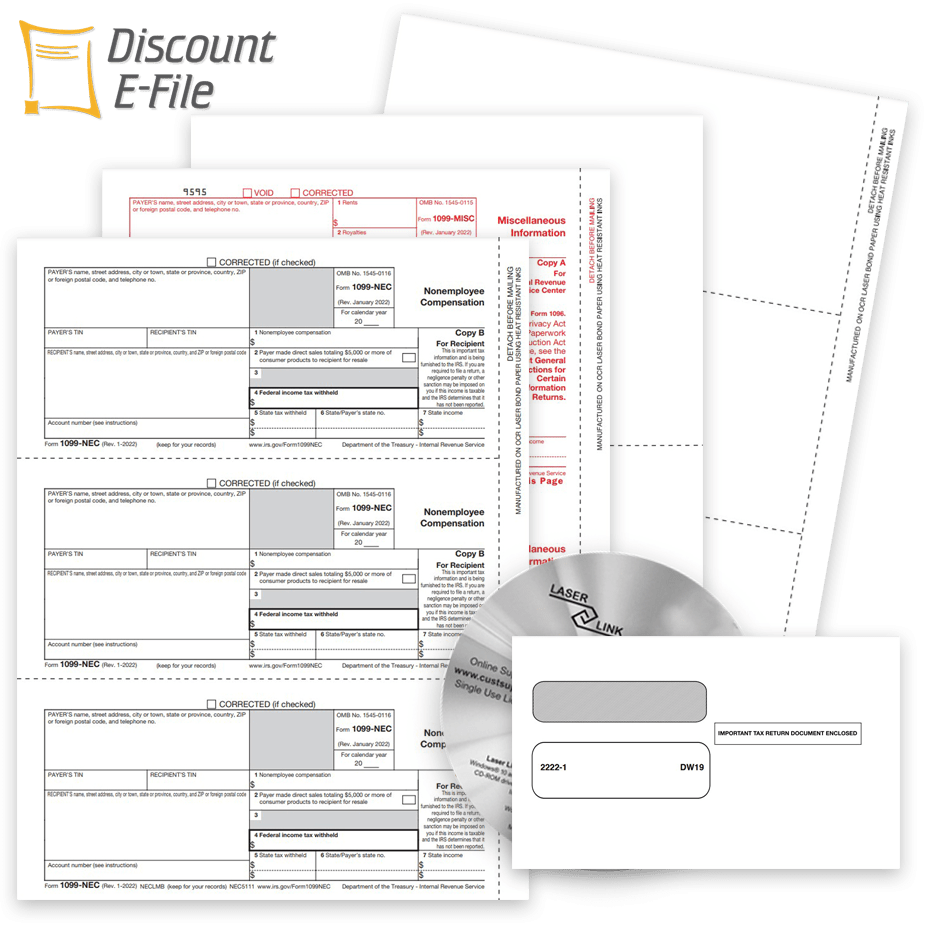

Payment coupon for irs. › forms-instructions-and-publicationsForms, Instructions and Publications | Internal Revenue Service The latest versions of IRS forms, instructions, and publications. View more information about Using IRS Forms, Instructions, Publications and Other Item Files. Click on a column heading to sort the list by the contents of that column. Enter a term in the Find box; Click the Search button › filing › free-file-do-your-federalIRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. › payPayments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

:max_bytes(150000):strip_icc()/taxextensionsfor2019and2020-8dcd5e625f194cf193880af9a3927dda.jpg)

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Post a Comment for "41 payment coupon for irs"