44 coupon rate and ytm

Current Yield vs. Yield to Maturity - Investopedia 12.10.2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... Maturity: Definition, How Maturity Dates Are Used, and Examples 18.04.2022 · Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed or it will cease to exist. The term is commonly used for deposits ...

Treasuries - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Coupon rate and ytm

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Yield to Maturity – YTM vs. Spot Rate: What's the Difference? 23.01.2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ... Yield to Maturity (YTM): Formula and Bond Calculation An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. The relationship between the yield to maturity and coupon rate (and current yield) are as follows.

Coupon rate and ytm. Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... How to Invest in Bonds | The Motley Fool 24.11.2022 · Bonds are a lower-risk way to increase your wealth than the stock market. Learn how they work and decide if they are a good fit for your financial goals. Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity. As some bonds have different characteristics, there are some variants of YTM: Yield to call (YTC): when a bond is callable (can be repurchased by the issuer before the maturity), the market … Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ... Yield to Maturity (YTM): Formula and Bond Calculation An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. The relationship between the yield to maturity and coupon rate (and current yield) are as follows.

Yield to Maturity – YTM vs. Spot Rate: What's the Difference? 23.01.2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

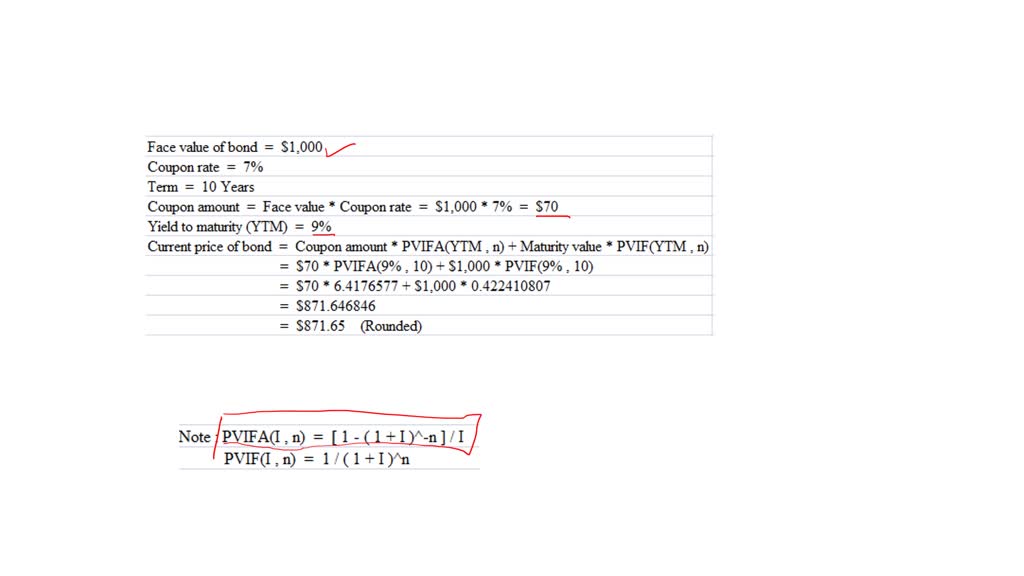

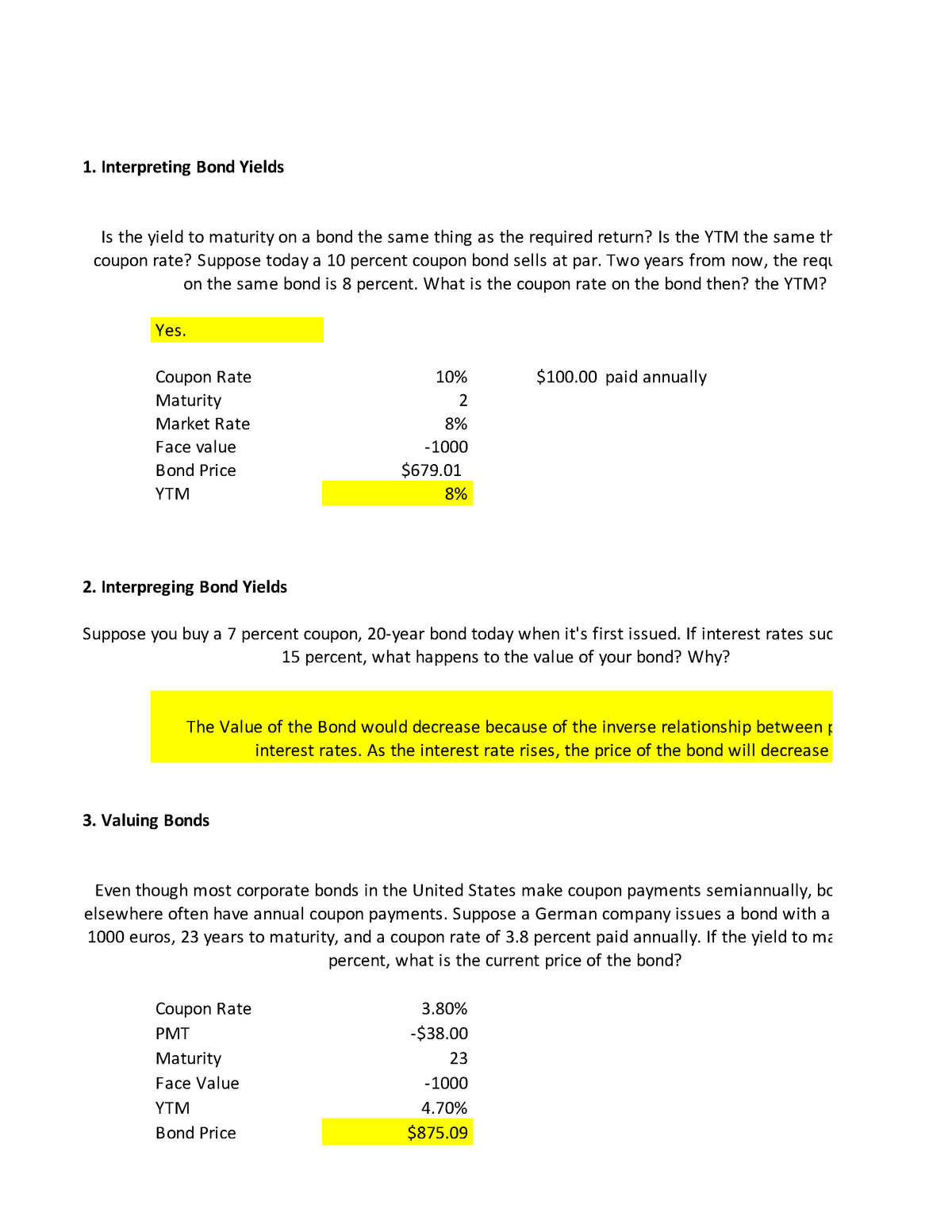

Bond Prices WMS, Inc., has 7 percent coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 9 percent, what is the current bond ...

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "44 coupon rate and ytm"