45 coupon rate semi annual

Companies with the largest debt in Nigeria - June 2022 The Company reported it issued a N115 billion semi-annual coupon bond at the rate of 7.5% per annum in December 30, 2020. The Bond proceeds were used to reimburse the shareholder loan and for working capital finance. How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

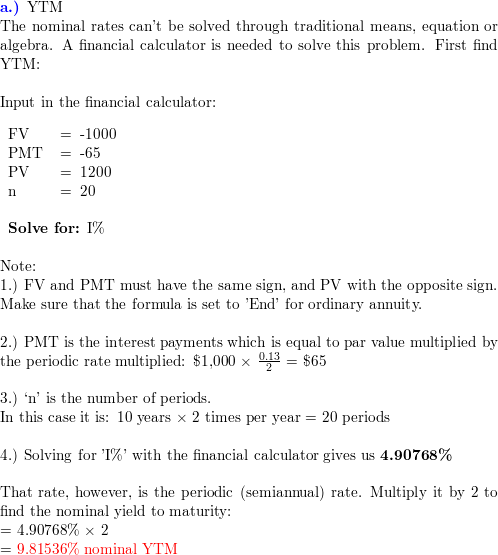

Solved What is the yield-to-maturity of a bond with the | Chegg.com Question: What is the yield-to-maturity of a bond with the characteristics below? Settlement date: August 31, 2022 Maturity date: August 31, 2023 Coupon rate: 3.50% Market price: 99.00 (per 100 face amount) Payment frequency: semi-annual You can solve for I/Y on your financial calculator or use the =Yield function in Excel.

Coupon rate semi annual

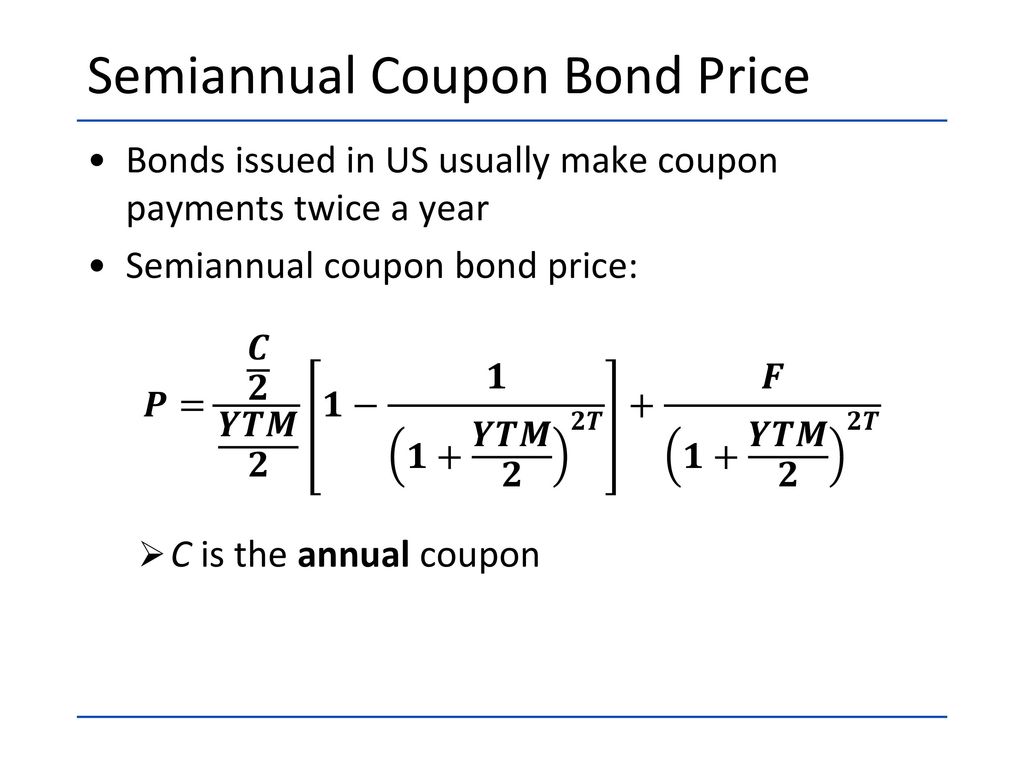

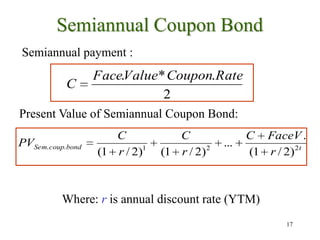

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Fixed Income Investing Guide - Forbes Advisor The bonds pay 4% semiannually on the face value of $1,000 and mature in 10 years. Under this scenario, each bond pays $40 annually in two payments of $20 each. At the end of 10 years when the bond ... Quant Bonds - Between Coupon Dates - BetterSolutions.com A corporate bond has a 10% coupon and a maturity date of 1 March 2020. It has a current dirty price if £118.78, The settlement date is 17 July 2014, SS - excel, settlement date, maturity date, frequency - 2 semi-annual, Day Convention / Basis, Coupon Rate, Coupon Days Accrued, Number of Days in Period, Quoted Dirty Price, Accrued Interest,

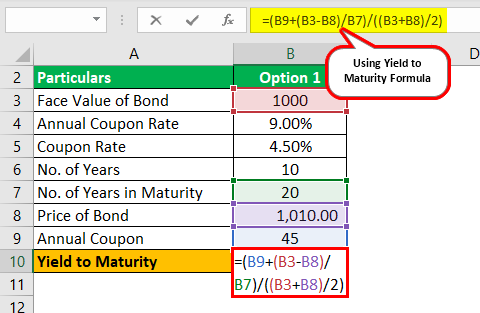

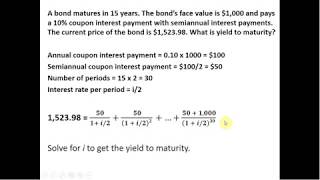

Coupon rate semi annual. Solved Valuing Semiannual Coupon Bonds Bonds Often Pay A Chegg A to 1000000 transcribed ratings 1 al periods periods current price 2 a 15000 twice 4-95 bonds 8 12 pay the bonds years view semiannual 4 - yield valuing semiannual present 100 semiannual 6 image text answer 2 full amount value 3 22 often 9-90 coupon maturity of coupon semiannual bond answer- year- rate coupon Quant Bonds - On A Coupon Date - bettersolutions.com 1) Calculate the number of coupon payments - The coupon is paid semi-annually so there will be 2 coupon payments a year, making 20 coupon payments in total, 2) Calculate the value of each coupon payment. The coupon rate will be 10/2 = 5% of the bond par value, so (1000 * 0.05) = $50. 3) Calculate the semi annual interest rate. (Solved) - 1. For each of the following pairs of ... - Transtutors A three-year zero-coupon ... PYS | Stock Snapshot - Fidelity Coupon Pay Frequency 1: Semi-annual : Original Coupon Rate 2: 6.3000% ... 2 Original Coupon Rate reflects the annual percentage rate payable when a security was first issued although it is usually not available or applicable for floating, adjustable, or variable rate securities. It may be very different from the security's current percentage ...

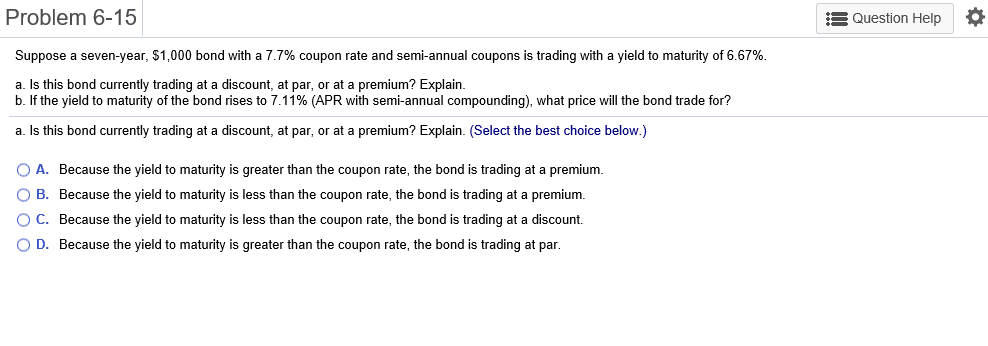

IDB launches $3 Billion 7-year Fixed Rate Sustainable Development Bond ... The transaction pays a semi-annual coupon of 3.500% and matures on 14th September 2029. It was priced with a spread of +46 basis points over SOFR mid-swaps, which equates to +21.6 basis points over the 3.125% UST due August 2029 and carries a semi-annual yield of 3.594%. ... The transaction marks the one of the largest 7-year dollar fixed rate ... How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond. Buy I Bonds in September 2022 at 9.62% | Keil Financial Partners The current semi-annual rate is 4.81%. Your September 2022 I bonds purchase will turn your $100 into $104.81 just 6 months later. This is a 9.62% annualized rate. After six months you'll get the new six-month rate, and your money will grow by that new rate. Suppose a seven-year, 51,000 bond with an 8.2% coupon rate and ... Suppose a seven-year, 51,000 bond with an 8.2% coupon rate and semiannual coupons is trading with a yield to maturity of 6.33% a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. If the yield to maturity of the bond rises to 7.36% (APR with semiannual compounding), what price will the bond trade for? CTT C.

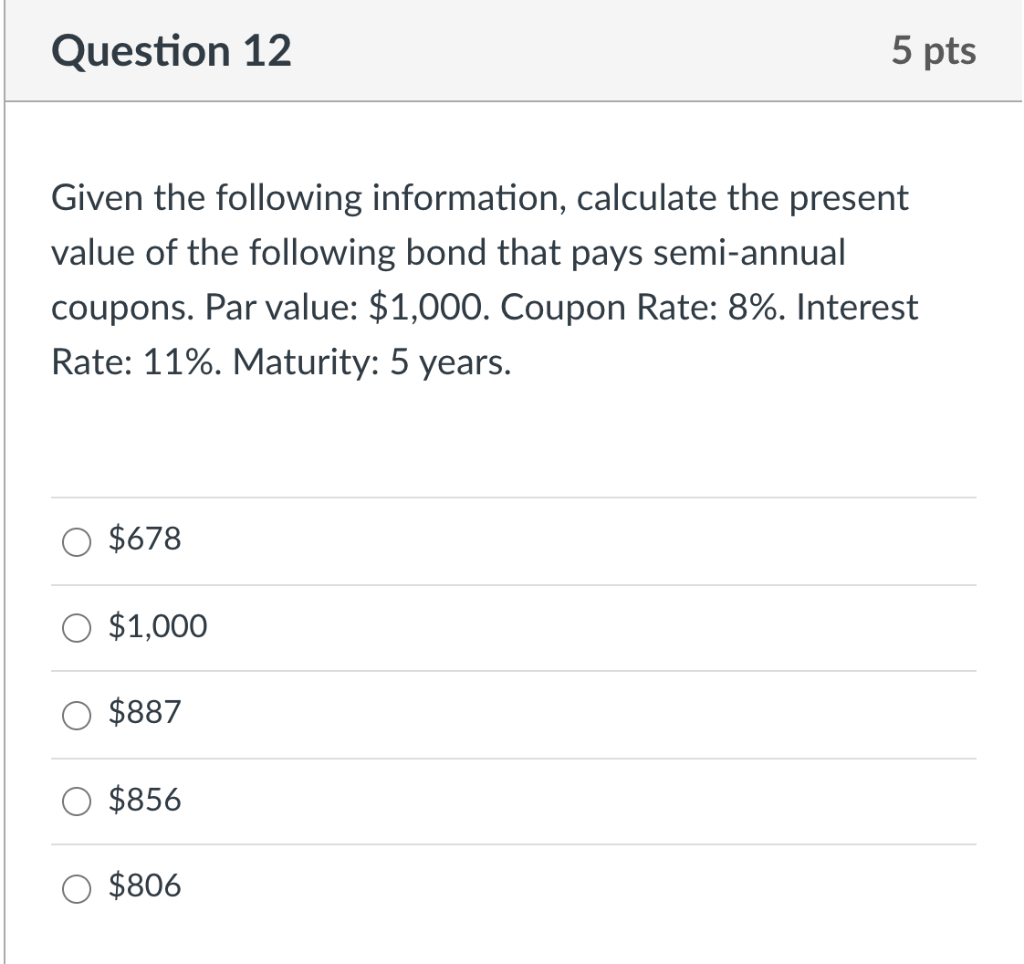

What Is Duration in Finance? - Investopedia Imagine a three-year bond with a face value of $100 that pays a 10% coupon semiannually ($5 every six months) and has a yield to maturity (YTM) of 6%. To find the Macaulay duration, the first step... How To Calculate Present Value Of A Bond With Semiannual Coupon the yield to maturity is the rate of return of a bond. in our example, we know that the par value is £1000, the coupon rate is 6%, for bonds that pay interest on a semiannual basis, we have to adjust the number of periods (multiply times 2), the yield (divide by learn how to calculate value of a semi annual coupon bond. semi annual coupon ... 41 coupon rate semi annual Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Dell Semi Annual sale: Save up to 50% on Dell XPS 13, Inspiron laptops ... Dell Inspiron 14 2-in-1: $799 $599 @ Dell, Save $200 on the new Dell Inspiron 14-inch 2-in-1 laptop. This a wise choice for students looking for a flexible laptop. It features a 14-inch (1920 x...

Sports Mans Guide Coupon Extra 25% Off Flash Sale Event Sitewide Offers + Free Delivery View Sale See Details FreshMenu Coupons: 60% + Rs.100 OFF Promo CodesJuly 2022 Enjoy free delivery on all orders by using coupon code. REVEAL CODE Verified Food Order Offers UPTO 30% OFF CODE Avail 30% Off On First Order Freshmenu is Offering flat 30% off on first order.

Factsheet | CHJMAO 4.000% Perpetual Corp (USD) - Fundsupermart.com Coupon Type 4 Annual Coupon Rate (%) ... Reset Rate: Prevailing 5-year UST Benchmark Rate + Initial Spread (2.238%) + one-time step-up of 300bps Reference Rate ; Semi Annually Annual Coupon Frequency Senior Unsecured Seniority HKEX ... Annual Coupon (USD) Amount Received at Maturity (USD) 3.937 %

38 lion country safari camping coupon coupon preview 2 18 18; coupon rate calculator semi-annual; coupon rate of a bond formula; coupon rate on us treasury bonds; coupon rate paid semi annually; coupon rate semi annual; coupon suzy free printable coupons; coupons for baskin robbins ice cream cake; coupons for car wash; coupons for duck tours boston; coupons for golden corral buffet ...

Ulta 20% Off Promo Code & 50% Sale ~ September 2022 - wikiHow Coupons Ulta coupon info. Vaild until. 20%. 20% off all Purchases at Ulta. ... Semi-annual sale: You can buy hair products at half the price at the semi-annual sale. Sale section. ... Rate Ulta. 5 of 5 stars determined by 4 votes. Shoppers that like Ulta discounts enjoy saving at these shops as well.

Banca Transilvania plans EUR 1 bln bond issues over the next ten years The Managing Board of Banca Transilvania (BVB: TLV) invited shareholders on October 18 to approve a programme of bond issues, with "a flexible structure, through several separate issues ...

IPB | Stock Snapshot - Fidelity Coupon Pay Frequency 1: Semi-annual : Original Coupon Rate 2: 6.0518% ... 2 Original Coupon Rate reflects the annual percentage rate payable when a security was first issued although it is usually not available or applicable for floating, adjustable, or variable rate securities. It may be very different from the security's current percentage ...

Mexico Treasury Bills (over 31 days) | Moody's Analytics - economy.com Issuance began in 2000. Long-term bonds - Bonos de Desarrollo del Gobierno Federal (BONOS): Fixed rate semi-annual coupon bonds denominated in pesos, issued in maturities of 10, 20 and 30 years. Bonds are auctioned each six weeks and traded based on its yield to maturity. Issuance began in 2001, 2003 and 2006 respectively.

South Africa Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 342 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

What Is a Coupon Payment? - Smart Capital Mind If someone purchases a bond for $1,000 US dollars (USD), for example, with a 10% interest or coupon rate, then he or she receives $100 USD each year as a coupon payment. This is typically paid out semi-annually, so he or she would receive a payment of $50 USD every six months.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Quant Bonds - Between Coupon Dates - BetterSolutions.com A corporate bond has a 10% coupon and a maturity date of 1 March 2020. It has a current dirty price if £118.78, The settlement date is 17 July 2014, SS - excel, settlement date, maturity date, frequency - 2 semi-annual, Day Convention / Basis, Coupon Rate, Coupon Days Accrued, Number of Days in Period, Quoted Dirty Price, Accrued Interest,

Fixed Income Investing Guide - Forbes Advisor The bonds pay 4% semiannually on the face value of $1,000 and mature in 10 years. Under this scenario, each bond pays $40 annually in two payments of $20 each. At the end of 10 years when the bond ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

![Coupon Rate: Formula and Bond Yield Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/10222811/Coupon-Rate-Formula-960x300.jpg)

Post a Comment for "45 coupon rate semi annual"