43 what coupon rate should the company set on its new bonds if it wants them to sell at par

Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer At 8% Vo = 96/2× [1- (1.04)^-42/0.04] + 1000 (1.04)^-42 … View the full answer Solved BDJ Co. wants to issue new 21-year bonds for some - Chegg BDJ Co. wants to issue new 21-year bonds for some much-needed expansion projects. The company currently has 8.6 percent coupon bonds on the market that sell for $1126, make semiannual payments, have a $1,000 par value, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Solved Uliana Company wants to issue new 15-year bonds for - Chegg The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

What coupon rate should the company set on its new bonds if it wants them to sell at par

FIN401 Exam 2 (Chapter 7) Flashcards | Quizlet Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 10% coupon bonds on the market that sells for $1,063, makes semiannual payments and matures in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Solved) - What coupon rate should the company set on its new bonds if ... 1 Answer to Bond Yields BDJ ... Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145.

What coupon rate should the company set on its new bonds if it wants them to sell at par. BDJ Co. wants to issue new 18-year bonds for some much-needed expansion ... The company currently has 9.9 percent coupon bonds on the market that sell for $1,139, make semiannual payments, have a par value of $1,000, and mature in 18 years. Required: What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not include the percent sign (%). FIN Flashcards | Quizlet 8 terms · West Corp. issued 18-year bonds 2 years ago at a coupon rate of 9.6 percent. The bonds make semiannual payments. If these bonds currently sell for 101 percent of par value, what is the YTM? → Bond YTM = Semi Annual YTM x 2… Solved What coupon rate should the company set on its new | Chegg.com Transcribed image text: PQR Co. wants to issue new 10-year bonds for some much- needed expansion projects. The company currently has 5.8 percent coupon bonds on the market that sell for $1,125, make semiannual payments, and mature in 10 years. Airbutus Co. wants to issue new 20-year bonds for some much- needed ... The coupon rate needs to be set to 8.75% for the bond to be sold at par value of $1,000. What is the relationship between yield and coupon rate? When yield is greater than the coupon rate, the bond sells at a price lower than the par value and vice versa.

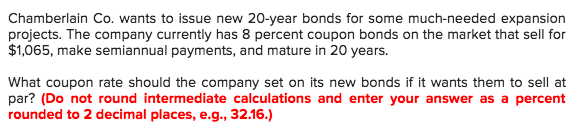

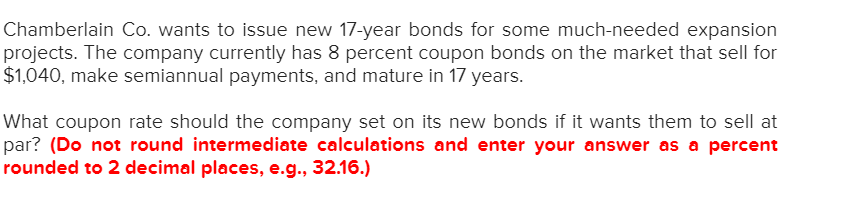

FNCE 3101 PS3. Rates and Bonds Valuation Flashcards | Quizlet Rollins, Incorporated, has a 15-year bond issue with a coupon rate of 4.5 percent that matures in 11.5 years. The bonds have a par value of $1,000 and a market price of $1,105.50. Interest is paid semiannually. What is the yield to maturity? a. 1.69% b. 4.07% c. 2.52% d. 3.38% e. 1.79% Coupon Rate the Company Should Set on Its New Bonds - BrainMass A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at. 11 chamberlain co wants to issue new 18 year bonds - Course Hero View full document. 11.Chamberlain Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 10 percent coupon bonds on the market that sell for $1,075, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? BDJ Co. - Coupon Rate Bonds - BrainMass BDJ Co. wants to issue new 10-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? First, we need to calculate how much ...

Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? simranstory9180 is waiting for your help. Add your answer and earn points. Expert-verified answer jepessoa Answer: 5.36% Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145. (Solved) - What coupon rate should the company set on its new bonds if ... 1 Answer to Bond Yields BDJ ... FIN401 Exam 2 (Chapter 7) Flashcards | Quizlet Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 10% coupon bonds on the market that sells for $1,063, makes semiannual payments and matures in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Post a Comment for "43 what coupon rate should the company set on its new bonds if it wants them to sell at par"